USDTRY has been slightly volatile in recent days, but ultimately range-bound. Investors should watch the exchange rate closely going forward as the demand for dollars has shot up in the banking system.

Recently, CBT's one-week swap auction witnessed record-high $10bn demand, with CBT filling only $1.25bn of this. Until a month ago, dollar demand at these swap auctions averaged under $2bn.

Local media report that the demand for dollars is higher because of seasonal requirements, which is probably true. If routine seasonality is the driver, then it will likely not move the lira by much either way.

Nevertheless, there is something not so routine about this year - CBT is managing demand and supply of funds in the banking system using a tightly-controlled set of market operations.

This set up can easily be accident-prone when the underlying volume of demand shifts rapidly - a spike in volatility would be the obvious outcome of watching out for.

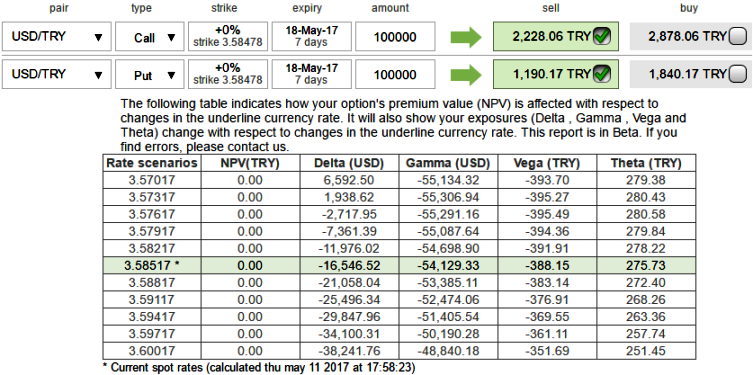

Option Strategy (Naked Strangle Shorts):

Please be noted that the IVs of 1w tenor have been flashing no dramatic prints, we think these vols are quite sensible on the above stated fundamental news.

For those whose foresee non-directional or no dramatic moves on either side and prefer to remain in the safe zone, we recommend shorting a straddle considering flat IVs or shrinkage.

Thereby, one can benefit from certain returns by shorting both calls and puts.(preferably short term for maturity is desired and ensure options greeks as shown in the diagram).

Maximum returns for the short straddle is achieved when the USD/TRY price on expiry is trading at or near spot levels only as both the instruments have to wipe off worthless. So that the options trader gets to keep the entire initial credit taken as profit.

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence