Technical glimpse:

After taking major support at 111.041, the pair has now broken out strong resistance at 112.670 to evidence mild upswings in short term upto 114.750 levels, both leading and lagging indicators signal interim buying momentum.

Margin: Not needed for Calls

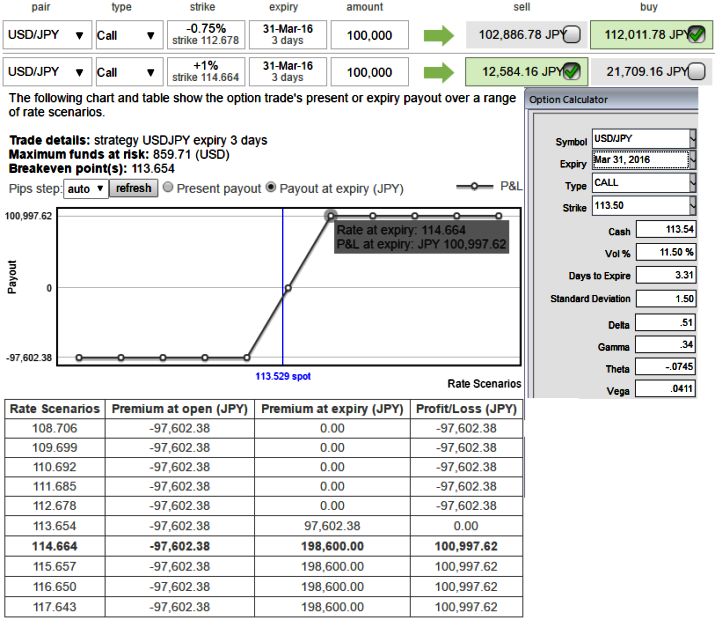

How to execute: As shown in the diagram, go long in 3D (0.75%) ITM +0.67 delta call option, and simultaneously short 3D (1%) OTM call with preferably positive theta or closer zero.

The Delta is continuously varying as the underlying spot FX fluctuates. Options further in-the-money (ITM) have a higher Delta. This indicates that ITM options are worth more per pip movement in the underlying market and out-the-money options are worth less per pip.

Strategy trade walk-through:

One can use the below strategy upon trading the expectation that the underlying spot FX of USDJPY would rise above 113.674. Even if it goes against, the maximum loss is limited by OTM strike price.

Max. Return: The profit is limited by OTM strike price (in this case, it is 114.664 where thee next resistance is likely). No matter how far the market moves above 114.664, the profit remains the same.

BEP level: As shown in the diagram, the break-even point remains between ITM and OTM strikes.

Max.Loss: The maximum loss is the net premium paid (for Calls) and is achieved when the underlying market moves below point A. A smaller loss is made between point A and the break-even point.

Impact of volatility factor: The 1W ATM IVs of this pair is at 10.9%, No significant effect is expected since we have dual leg in our strategy.

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025