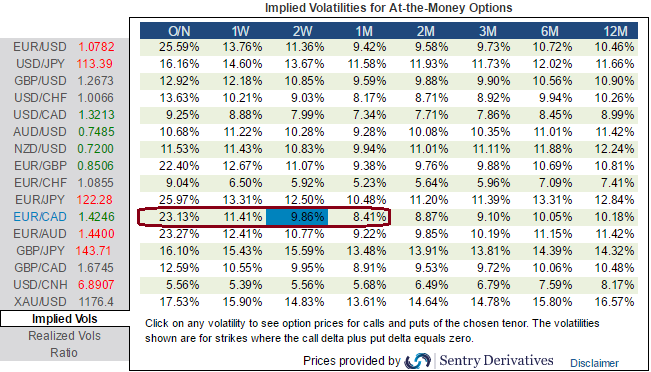

The current EURCAD ATM implied volatilities making extreme noise above 23% as the EUR heads into today's ECB meeting on the front foot, having staged an aggressive reversal post initial Italian referendum weakness on Monday.

As usual, the interest rate announcement will be made at 12:45GMT, with further measures and new economic forecasts, expected at the press conference starting at 13:30GMT. The ECB is widely expected to ease policy further.

But more notably, the extremely higher side IVs are most likely to shrink away significantly in 1w and 1m tenors after the above mentioned economic event which is conducive for the option writers.

EURCAD’s range bound pattern is still persisting (see rectangular shaped area in weekly technical charting) as the bullish effects attempting to bring the trend back in range and are indicating slight strength in daily terms, (Ranging between upper strikes 1.4931 and lower strikes at around 1.4186 levels.

Positively skewed 1w implied volatilities would imply that the hedgers are anticipating on upside risks in this timeframe but please be in formed that the trend has been going in range.

Option-trade recommendations:

We could still foresee range bounded trend to persist in near future on weekly basis. Subsequently, we recommend below option strategies using right options, thereby, one can benefit from certain returns.

Naked Strangle Shorting:

Short 1W OTM put (1.5% strike difference referring lower cap)and short OTM call simultaneously of the same expiry (1% strike referring upper cap) (we reiterate, preferably short term for maturity is desired).

Overview: Slightly bullish in short term but sideways in the medium term.

Time frame: 7 to 10 days

At current spot at 1.4256 with range bounded trend keeping in consideration, we would like to remain in a safe zone by achieving certain returns though shorting a strangle.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts