Outperformer Kiwi dollar has extended recent gains, from 0.6905 to 0.6941, helped by a solid GDT dairy auction.

The GDT dairy auction resulted in a 4% rise in prices overall, whole milk powder up 5% (for a total gain of 16% since the early March trough) as was indicated by NZX futures.

Strong support at 0.6850 for a push higher to the 0.7000 area, assuming no negative surprise from the fickle NZ jobs data today. Rising dairy prices and a possibly more upbeat RBNZ next week should be supportive during the week ahead.

NZDUSD in medium term perspectives: The Fed’s tightening cycle plus US fiscal expansion should maintain upside pressure on US interest rates and the US dollar, pushing NZDUSD below 0.6900. The RBNZ’s persistent reminders it is on hold for a long time should also weigh.

Option Trade Recommendations:

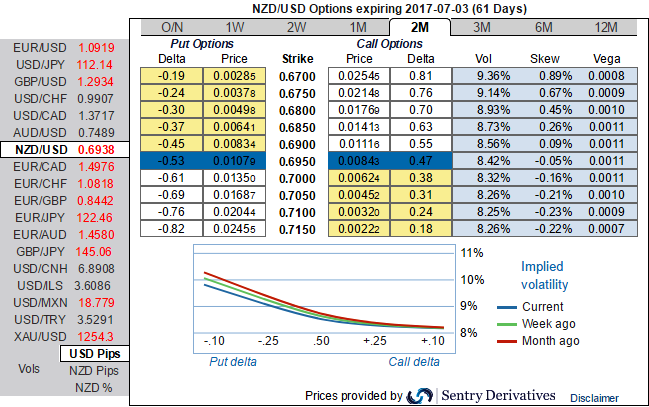

All the factors are discounted in FX options market, you could make out this in mounting risk sentiments as you could see the positively skewed IVs in OTM put strikes in 2m tenors (refer positive IV skews indicate the strikes below 0.69 which is our forecasts).

The NZD volatility market normalized sharply (you could observe that in NZDUSD IV skews across all tenors) and IV skewness is quite favorable for OTM put option holders, hence, we eye on writing overpriced out of the money put options that likely to reduce hedging costs of long legs.

Well, these positive skews in 2m implied volatilities signify hedging interests in downside risks and the combination of IV 2w2m skews suggest credit put spreads that is likely to favour both upswings in short run and major downtrend.

At spot reference: 0.6940, one can also deploy diagonal credit put spreads by writing 2w (1%) in the money put while initiating longs in 2m at the money put, the structure could be constructed at net credit.

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts