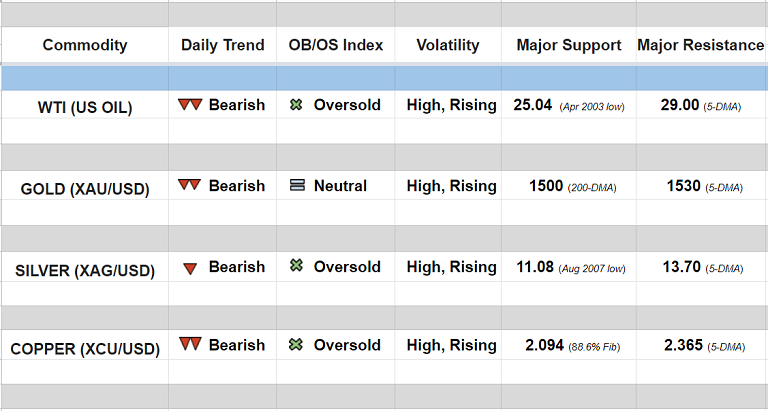

Daily Commodity Tracker (12:00 GMT)

WTI (US OIL):

Major and minor trend - Strongly bearish

Oscillators: Oversold (no sign of reversal)

Bollinger Bands: Widening on Daily, Weekly and Monthly charts

Intraday High/Low: 27.21/ 25.10

GOLD (XAU/USD):

Major trend - Neutral; Minor trend - Strongly bearish

Oscillators: Neutral (Bias lower)

Bollinger Bands: Widening on Daily and Weekly charts

Intraday High/Low: 1546.426/ 1487.422

SILVER (XAG/USD):

Major and minor trend - Strongly bearish

Oscillators: Oversold (no sign of reversal)

Bollinger Bands: Widening on Daily, Weekly and Monthly charts

Intraday High/Low: 12.9004/ 12.2156

COPPER (XCU/USD):

Major and minor trend - Strongly bearish

Oscillators: Oversold (Bias lower)

Bollinger Bands: Widening on Daily, Weekly and Monthly charts

Intraday High/Low: 2.340/ 2.189

FxWirePro: Daily Commodity Tracker - 18th March, 2020

Wednesday, March 18, 2020 12:01 PM UTC

Editor's Picks

- Market Data

Most Popular

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts