The dollar index (DXY) was pulled back (-0.54% at the time of articulating) after a steady start to the week by a weaker than expected reading for durable goods orders amid fresh uncertainty surrounding the Fed’s tightening plans.

Some FOMC members – amongst them President of the Chicago Fed Charles Evans, President of the Philadelphia Fed Patrick Harker as well as President of the Dallas Fed Robert Kaplan – spoke up in favor of a rate pause recently. The recently weaker development of inflation rates has clearly caused some uncertainty amongst FOMC members. This confirms our economists in their view that the next Fed rate step will only be taken in December. The market sees the likelihood of a rate hike at the September meeting (i.e. the next meeting with a press conference) as standing at below 20%, thus agreeing with this expectation.

The latest CFTC positioning data recorded a small net increase in long, non-commercial dollar positions in the latest week, primarily due to a sharp paring of short dollar positions against the Euro.

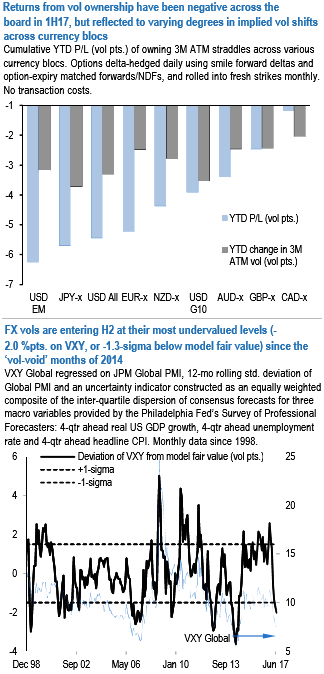

H1’17 has not made vol buying great again. YTD returns from straddle ownership have been negative across the board, with the biggest pain reserved for USD/EM (refer above chart) courtesy the divergent fortunes of the US administration’s domestic and international policy agenda: not only did setbacks around ACA repeal and tax reform at home tame neuroses around disorderly bond market weakness, but also greater success in coaxing bilateral dollar weakness out of Asian trade partners –Korea and Taiwan at the beginning of the year, and arguably CNY more recently – helped anchor broader EM FX sentiment.

The French elections also sidestepped a major banana skin by delivering an expected mainstream Presidency, while the surprising outcome of the UK general election had little ramifications for ex-GBP currencies; in short, no Brexit or Trump-like upheavals, hence unflattering vol returns. VXY is entering H2 having declined an eye-watering 4 %pts from its 1Q highs, one of the largest half-yearly drops on record outside of the GFC.

Consequently, as per the JPM Global PMI, FX vols have collapsed to their least levels since the Great Moderation of 2014. A simple econometric model of the VXY constructed with a global business cycle variable, a proxy for growth surprises (rolling 12-mo std. deviation of global PMI) and an uncertainty indicator (average inter-quartile dispersion of consensus forecasts for 4-qtr ahead real US GDP growth, 4Q ahead unemployment rate and 4Q ahead headline CPI provided by the Philadelphia Fed’s Survey of Professional Forecasters)shows that VXY that Global at 7.5 is 2.0 % pts too low versus fair value, amounting to a 1.3 std. error mismatch (refer above chart).

So the cheapness of FX vols is assuming significant proportions, but still some distance away from the -1.5 to -2-sigma undershoots witnessed during the equity bubble of the early 2000s, ahead of the credit crisis in fall’07, in the lead-up to taper-tantrum in 2013 and before the onset of the current cycle of Fed tightening in mid-2014.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?