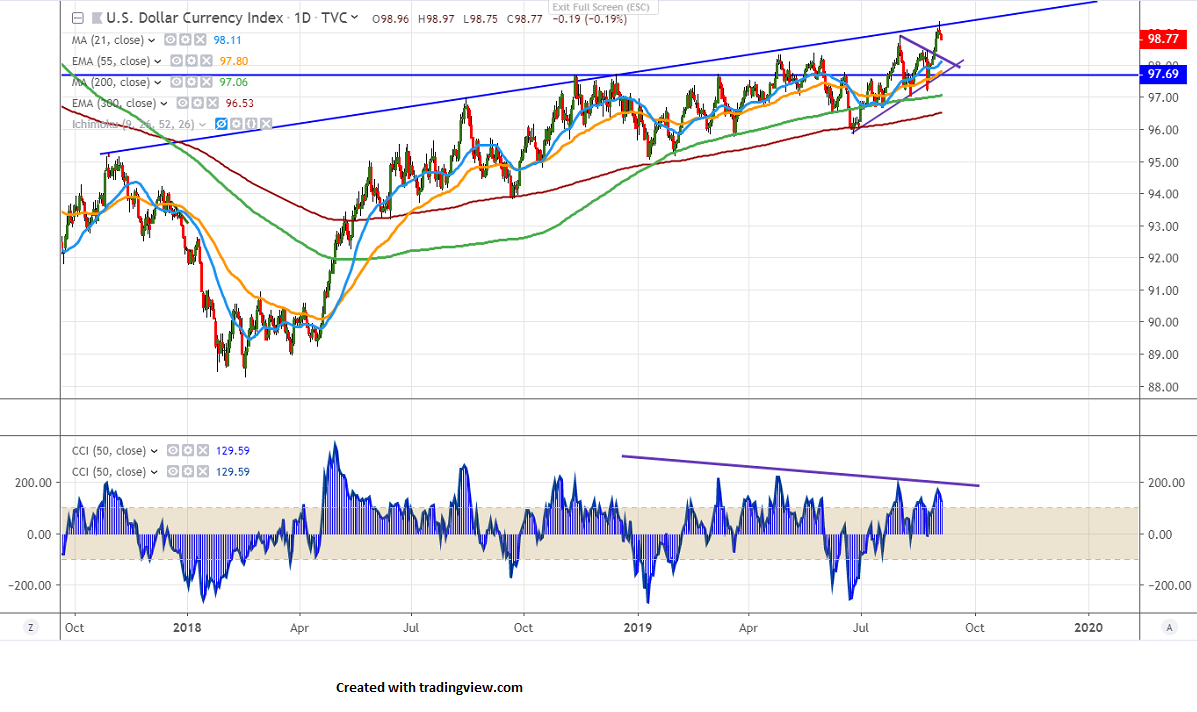

Major trend line resistance- 99.30

Candlestick pattern- Shooting star

US dollar index has halted its 1 week of the uptrend and shown a minor decline of more than 50 pips n profit booking. The index took support near 200- day MA and jumped more than 200 pips. It hits 2-1/4 year high around 99.35 yesterday. US 10 year yield continues to trade lower and hits 1.428% lowest level since Jul 2016. The probability of a 50 bps rate cut has increased from 0% to 9.6% after weaker than expected US ISM manufacturing data. It hits an intraday low of 98.81 and is currently trading around 98.83.

The index is almost in overbought zone and minor dip till 98.30-35 is possible.

The near term support is around 98.60 and any break below will drag the index down till 98.20/98/97.70. Any daily close below 97 confirms bearish continuation.

It is good to sell on rallies around 99 with SL around 99.35 for the TP of 98.30.