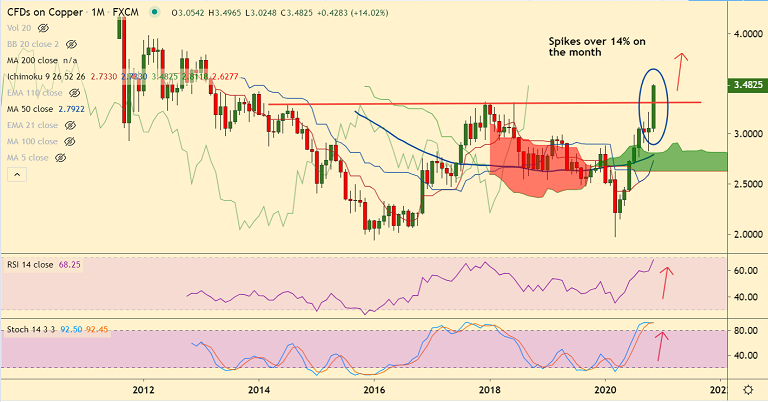

Copper chart - Trading View

Copper spikes over 2% on the day to hit 3.496 before trimming some gains to trade at 3.485 at around 06:50 GMT

Prices have risen over 14% for the month of November and bulls remain in control with more upside on charts.

Upbeat China PMI data which affirms recovery in the worlds second largest economy fueling gains in commodities.

The data released early Monday showed China's economic activity extended its strong growth in November.

China's official manufacturing purchasing managers' index (PMI) rose to its highest since September 2017, printing at 52.1 in November from 51.4 in October.

The official non-manufacturing PMI ticked higher to 56.4, its highest reading since June 2012.

Hopes of progress in developing COVID-19 vaccines which could spur a swift global economic revival were also supporting commodity prices.

Technical bias is strongly bullish. Price action has confirmed a Wedge breakout. Bulls have broken past 3.422 (Jan 2014 high). Next bull target lies at 3.575 (March 2013 high).