Despite a strong Christmas recovery in the US equity avenues, the broader market has largely snubbed the passage, with US yields and the USD remaining under pressure, amid such market sentiment, we emphasize on a RV implementation in the FX Vol space that efficiently eases tactical VIX declining slope over the next few weeks. The past few weeks were depicted by the tension on Equity markets, which nonetheless on average failed to propagate materially to the FX space (including EM), exhibiting a similar behaviour to the one from February.

Still, with a VIX at 21, having reached a post-February maximum of 25 two months ago, it is tempting to consider opportunities in the FX vol space for playing a further decline in the VIX (it remains 75% higher than the early October levels).

As the JPM’s equity derivatives crew projects a decline of the US Equity vol from current elevated levels in 2019, several factors also point to a short-term relief in market stress, amongst which increased expectations of a short- term easing in US/China trade tensions, more conciliatory tones in the Italy-EU dialogue regarding fiscal budget, and Theresa May’s confidence vote win earlier this week that possibly reduces the chances of a hard-Brexit.

While the structural factors supporting our strategic view that FX Vols are poised to rise over 2019 remain intact, the recent softening in the Fed stance is lending a helpful hand in relieving the recent downbeat sentiment pressures. With the holidays just around the corner, FX vol (VXY-GL down almost 0.5pts since the early Dec high) is on track to get a breather.

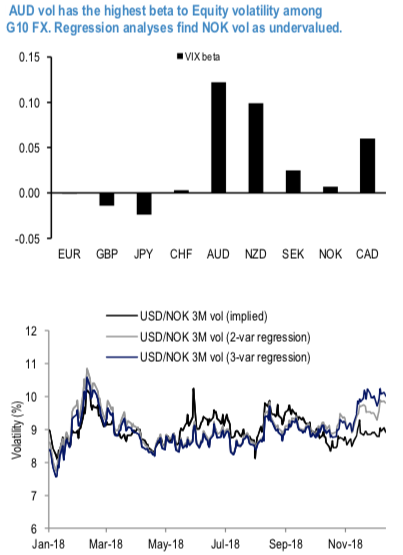

The abovechart displays the VIX-beta for DM FX vols (against the USD), in a 2-dimensional regression (with data since 2005) using also the VXY vol index as a regressor. Based on the chart, we note that AUD is the G10 FX volatility showing the highest sensitivity to the VIX, a specific which clearly manifested itself in early December. Investors interested in participating in a calmer year-end could consider tactically selling AUD vol for playing a lower VIX level over the next few weeks. Based on the same analysis, NOK vol is one of the least exposed to moves in the VIX.

Given the sensitivity of the currency to Oil prices, in the bottom chart (zooming on 2018 data) we compare USDNOK implied vol with two fair value regressions, one using the two factors described above, one incorporating Oil volatility as a third regressor. NOK volatility is undervalued in both (2- and 3-factor) regressions by around 1vol, having failed to react to a sharp rise in Oil volatility (to which it is positively exposed) in early November. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index has flashed at 37 (which is mildly bullish), while hourly EUR spot index has shown -31 (mildly bearish), while articulating at 10:09 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed