The statement from BoC’s March 1st meeting reiterated the point that, unlike the US, Canada was an economy that continues to be beset by material excess economic slack, and thus warrants a policy stance that remains very dovish.

This reinforce an argument made by Governor Poloz in his January policy meeting press conference that because of this cyclical divergence, it is unjustified for rising US rates and USD to drag up higher Canadian rates and CAD (in trade-weighted terms), and that recent tightening in monetary conditions from both rates and the currency was unconstructive for Canada.

This point of view played out this past month, as the sharp move 23bp higher in US 2y yields largely did not spill over into Canada yields.

OTC updates and hedging vehicles:

At spot ref: 1.4363 (while articulating) we advocate below FX derivatives strategy as we favor optionality to the directional trades. For the bearish streaks that we are inclined to position a partial retracement of the down move through put spreads, as calling the bottom is difficult and adding directional spot exposure is risky at the moment.

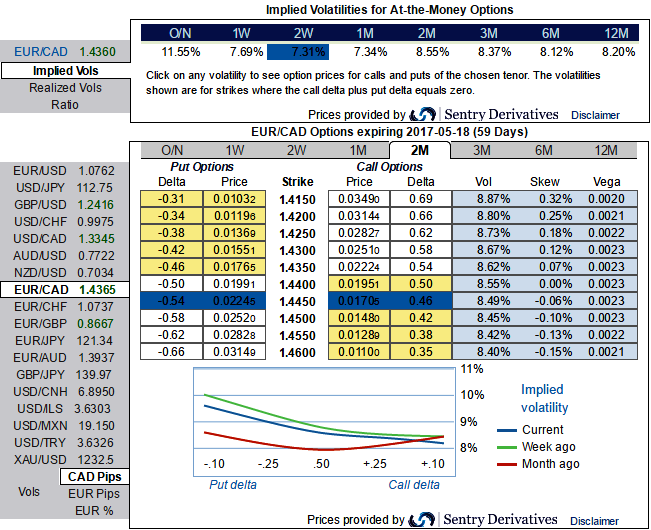

Alternatively, using any abrupt rallies, you decide to initiate a diagonal debit/bear put spread (DDPS) at net debit 2w ATM IVs of EURCAD is at 7.31%, and likely to spike higher 8.55% in 2m tenor. While positively skewed IVs of these tenors indicate hedgers’ interest in OTM put strikes that implies downside risks in the underlying spot FX.

The execution: Initiate shorts in 2W (1.5%) out the money put with positive theta, simultaneously, buy 2M in the money -0.5 delta put option. Establish this option strategy if you expect that EURCAD would either expect sideways or spike up abruptly over the next near future but certainly not beyond your upper strikes.

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic