The Bank of Canada will leave its key rate unchanged today. What will be more interesting, however, is whether it will comment on the level of the Canadian dollar - the top performer in the G10 universe this year.

The Bank of Canada will leave its key rate unchanged today. Nevertheless, today's monetary policy decision could be anything but boring for the Canadian dollar as there is an increasing number of voices that the latest CAD appreciation could go too far. At least some market participants will, therefore, hang on BoC Governor Stephen Poloz's every word today. The CAD has appreciated by a good 3% against the US dollar since June alone. Among the G10 currencies, it has thus been the top performer since the beginning of the year. Nevertheless, we doubt that the BoC will comment explicitly on the currency. Because, in view of the well-functioning economy and inflation, which is comfortably within the target range, there is actually no immediate cause for concern for them - and why should one wake up sleeping dogs south of the national border with statements on the currency, if those like to put their trading partners on the defensive with accusations of currency manipulation?

But of course, the BoC has little interest in the market becoming too optimistic about its monetary policy and the CAD. In the end, there are still numerous global uncertainty factors that cloud the outlook. In particular, the continuing fears of a global recession result in downside risks for the oil price, which could quickly turn the outlook for the Canadian economy into the opposite. The BoC is, therefore, best advised to exercise cautious restraint: Acknowledge the recent good economic signals, point to the ongoing downside risks and wait and see what exactly the Fed will signal. In this case, the CAD should hold up well at the current USDCAD levels around 1.31 for now. While GBPCAD has been consolidation phase, now turning into the bearish mood. The pair has been oscillating between 1.8415 and 1.5837 levels from the last 2-3 years. Please observe above technical chart for the major downtrend.

OTC Updates and Options Strategy:

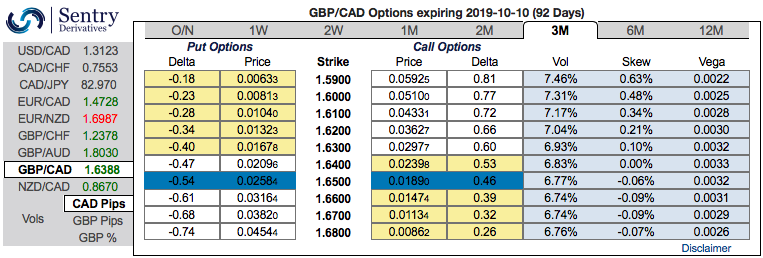

The positively skewed GBPCAD IVs of 3m tenors have still been signaling bearish risks, the hedgers’ interests to bids for OTM put strikes up to 1.59 levels indicating downside risks in the medium terms (refer 1stchart).

Accordingly, we advocated options strips strategy to address any abrupt upswings in short-run and the major downtrend.

We’ve been firm to hold on to this strategy on both trading as well as hedging grounds, unlike spreads, combinations allow adding both calls and puts at a time in our strategy.

Buy 2 lots of 3m at the money delta put option and simultaneously, buy at the money delta call options of similar tenors. It involves buying a number of ATM call and double the number of puts. Please be noted that the option strip is more of a customized version of options combination and more bearish version of the common straddle.

Attractive returns are achievable with this strategy when the underlying currency exchange rate makes a strong move on either downwards or upwards at expiration, but greater gains to be made with a downward move. Hence, any hedger or trader who believes the underlying currency is more likely to spike upwards in short run but major downtrend can go for this strategy. Cost of hedging would be Net Premium Paid + brokerage/commission paid. Courtesy: Sentrix & Commerzbank

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook