We articulated a high conviction, constructive view for EUR predicated on the robust cyclical lift in the region and the unwinding of distortions to capital flows and EUR valuation from the unconventional monetary policy.

We also stated that EURJPY PPP and FEER valuations are the yen bear’s arch-enemies, but they apply far more to the USDJPY than to the EURJPY, given that the euro, too, is significantly undervalued on a PPP basis. The PIIE puts a FEER-consistent EURJPY rate at 121. More important perhaps than the valuations, however, is our confidence that the ECB is further along the road to policy normalization than the BOJ.

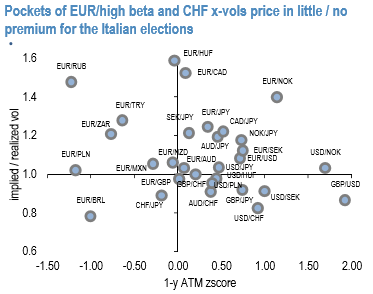

Low-cost benign outcome calendar spreads: It is worth considering low-cost opportunities for the high-probability, central scenario of a benign outcome to the vote and a resumption of the euro uptrend, albeit a shallower and less impulsive uptrend than seen in December and January in view of EUR’s stretched positioning and short-term valuation metrics.

Among EUR-crosses, the EURJPY and EURUSD vol curves look particularly distorted, with 1M ATM trading more than one vol above 3M ATMs. As the curve is unlikely to invert further, it’s worth considering short front vs. long back calendar spreads of EUR calls/JPY puts (or EUR calls/USD puts).

The rationale:

a) The tactical EUR topside is limited as far less risk premium is currently priced into EUR relative to e.g. the 2017 French elections,

b) The selling shorter-dated EUR calls through such calendars avoid the unlimited tail risk of an MS5 victory as witnessed in some recent events (refer above chart).

Short 2w (or immediately post-event) 40D EUR calls/JPY puts vs. long 2M EUR calls/JPY 40D/20D puts spreads costs 5bp, a fraction of the premium of buying 2M call spread outright (65bp).

Currency Strength Index: FxWirePro's hourly EUR spot index is displaying shy above -22 levels (which is bearish). While hourly JPY spot index was inching towards 99 (bullish) while articulating (at 11:00 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays