In our recent posts, we’ve emphasized the significance of the GBP risk reversal expressions precisely both for short-term as well as long-term basis.

GBP weakness is at the forefront of G10 FX markets as Brexit politics has heated up.

The macro strategies have slashed the sterling forecasts recently as UK politics is increasingly leaning towards a hard Brexit, which raises odds of a larger-than-expected hit to medium term growth and risks worsening an already challenging BoP deficit; we now expect year-end levels of 1.21 on cable and 0.95 on EUR/GBP.

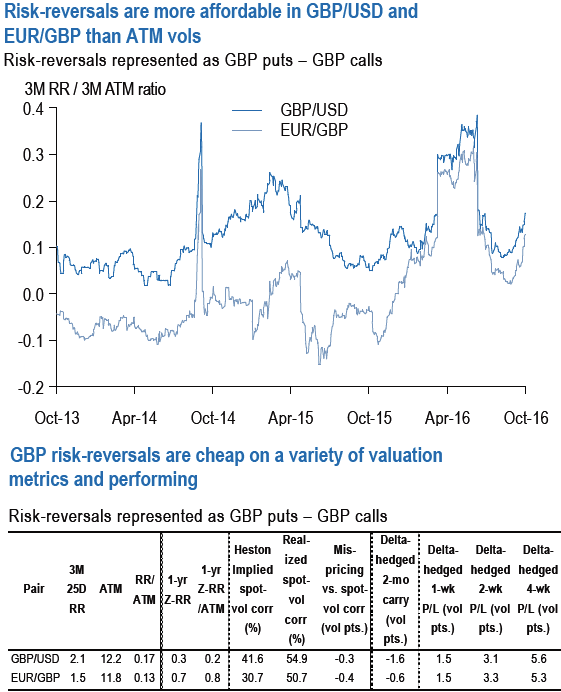

In our view, option expressions of GBP weakness are best expressed in a risk-reversal-lite format, since ATM vols have already richened to levels where the risk-reward of fresh longs is questionable.

In contrast, riskies are more affordable (see above chart), cheap on a variety of valuation metrics and have been performing handsomely (glance through the table).

One constraint on buying risk-reversals outright is spec investor positioning which has widened back out to multi-year extremes of shorts on GBP IMMs after a few weeks of risk reduction mid-summer, and can serve to limit the pace of sterling depreciation.

For directional investors, two option expressions that benefit from contained pound weakness resulting from such a positioning set-up yet retain a small long risk-reversal exposure are:

i) Seagulls: e.g. long 3M 1.20 – 1.15 cable put spreads financed by selling 1.30 strike GBP calls/USD puts cost 55bp GBP in premium (spot ref. 1.2236, vs. 172bp on the standalone 1.20 and 100bp for the 1.20-1.15 put spread).

ii) At-expiry digital risk-reversals: admittedly very little skew exposure to such spreads but satisfy the basic criterion of selling relatively expensive GBP calls for financing purposes; long 3M 1.20 GBP put/USD call digital vs. short 3M 1.28 GBP call/USD put digital costs 10% GBP (spot ref: 1.2236, vs.34% GBP for the 1.20 strike).

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data