How will CNY perform if a trade deal can be reached? It is believed that this is the key question for every market player at this moment. Some would argue CNY could strengthen as the risk sentiment will improve. To be blunt, the so-called "market sentiment" is somehow like my son's mood swings.

Therefore, we can’t only cite “market sentiment” to justify the currency movements. CNY will ultimately depreciate no matter whether a trade deal can be reached. If a deal can be struck, CNY will weaken as China's current account surplus will be shrinking simply because China will have to purchase substantial amount of goods from the US, although the US probably don’t want to see a weaker CNY.

If both sides can't reach an agreement, indicating that the trade tensions are likely to re-escalate, CNY will also depreciate as growth outlook will be gloomier. That said, purely from a trade talk perspective, any constructive view on CNY is still dubious.

Hence, the news that the US canceled the preparatory trade talks, which was later denied by Larry Kudlow, head of the National Economic Council, will only create some market volatility, but won’t change my opinion at all.

OTC FX updates:

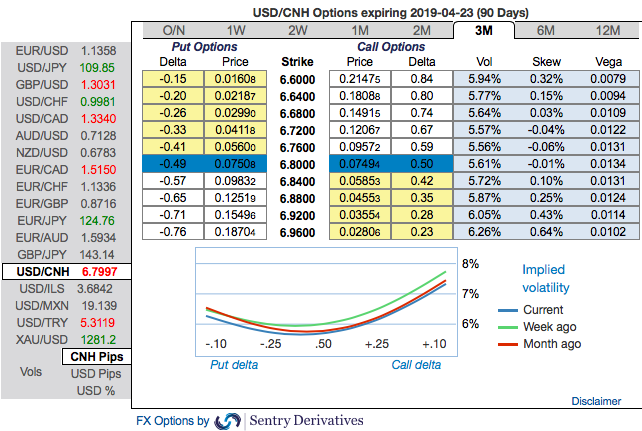

You could easily make out that the positively skewed IVs of USDCNH have been stretched out on either side (refer above nutshell). This is interpreted as the hedgers' bid for both OTM calls and OTM put options.

Trade tips: Contemplating above factors, we advocate buying 7M 40D (6.98 strikes) USD calls/CNH puts vs sell 7M 4.5052 - 5.1658 AUDCNH Strangle. Courtesy: Sentrix & Commerzbank

Currency Strength Index: FxWirePro's hourly CNY spot index is inching towards -77 levels (which is bearish), while hourly USD spot index was at 61 (bullish) while articulating (at 13:54 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge