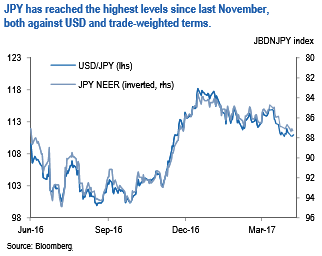

JPY has broadly appreciated against the major currencies. The Japanese currency has reached the highest levels since last November both against USD and trade-weighted terms (refer above chart).

After the FOMC announcement on Mar.15, lower UST yields and narrower U.S.-Japan yield spreads have led USDJPY lower.

In coming weeks, however, politics will likely become the main driver of USDJPY. We will have the U.S. Treasury’s semi-annual report on foreign currency policies (before April 14?), the U.S.Japan economic dialogues (on April 18) and the 1st round of French presidential election (April 23).

In aggregate, we believe that relevant risk is skewed towards downside for USDJPY.

Bullish USDJPY scenarios: The pair likely to hit 125 if 1) The strong US growth leads aggressive Fed hikes and a spike in UST yields, resulting in broad USD strength, 2) Japanese government’s fiscal policy becomes more expansionary and the BoJ finances it, resulting in higher Japan’s inflation expectations.

Bearish USDJPY scenarios: The pair likely to 100 if 1) The global investors’ risk aversion heightens significantly, 2) weak US economy dampens hopes for Fed hikes and leads broad USD weakness.

US-treasury annual FX report (before Apr14)

U.S.-Japan economic dialogue (Apr18)

BoJ meeting (Apr 27) Ordinary session of Diet.

Option Trades Recommendation:

Buy USDJPY 1y ATM straddle.

Short a 1m USDJPY 116 put.

Long a 6w USDJPY 100x98x96 1x2x1 put fly.

Buy a 2m 118.50-116.00 USDJPY put spread vs 122.50-125.00 call spread.

Long a 2m 108.0 USDJPY one-touch put; short 1m put expired.

Buy 3m USDJPY FVA.

Buy 2y USDJPY ATM, Short USDJPY 3m vs. buy 1y ATM, vega neutral.

Buy 6m JPYKRW vs USDJPY ATM spread.

Buy 6m EURUSD ATM and 6m USDJPY ATM vs. sell 6m EURJPY ATM in 60:100:-150 vega ratios.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields