Bearish EUR scenarios:

1) The market prices in three Fed rate hikes in 2018; or

2) Non-traditional parties prevail in German or Italian elections.

Bullish EUR scenario:

1) Equity inflows accelerate into the region further.

2) Trade protectionism delays Fed tightening.

3) The US initiates a trade war with China, Mexico, Japan or the EU.

4) ECB becomes more hawkish.

Bullish JPY scenario:

1) Global investors’ risk aversion heightens significantly.

2) Weak US economy dampens hopes for Fed hikes and leads broad USD weakness.

Bearish JPY scenarios:

Japanese government’s fiscal policy becomes more expansionary and the BoJ finances it, resulting in higher Japan’s inflation expectations.

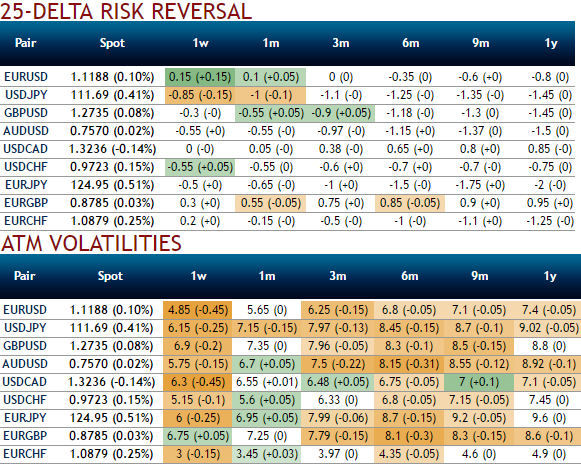

Please be noted that the bearish-neutral risk reversals with shrinking implied vols and with positively skewed IVs signify the call writers’ advantage.

For vols traders, speculative grounds we advocated short 1w EURJPY straddles (strike at 124.9480), this strategy has been devised in order to gain vols advantage.

For aggressive but directional bearish traders, buy 6m vs sell 3m EURJPY 110 One-Touch puts, 0.758:1 notionals.

For highly aggressive bears, on hedging grounds, the collar is a good strategy to use if the options trader is writing covered calls to earn premiums but wish to protect himself from an unexpected sharp drop in the price of the underlying security.

To execute this strategy, the underlying spot exposure + short 2w (1%) OTM call + long 1m ATM put.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?