The Australian dollar is back below 1.8174 again vs the GBP and below 0.70 against USD. Following the Xi-Trump tariff ceasefire agreement at the G20 Summit, the focus has returned to fundamentals.

On a relative basis, the monetary policy outlook for Australia is considered more dovish than the US. According to consensus, the Reserve Bank of Australia has lowered its cash rate target by 25 bps to 1.00% at today’s meeting. This has been a back-to-back rate cut after the last ease on June 4th. As a result, the reaction in the AUD exchange rates was reasonably moderate. Moreover: there was something for everyone. The element in favor of AUD shorts was that at least for some observers the rate step came as a surprise.

However, what was probably more important was a change in the statement that supports AUD longs. Interest rate futures are looking for the RBA to keep the door open for another rate cut, which in turn, will weigh on the Oz.

On the flip side, as Brexit uncertainty intensifies, GBP crosses are apprehensive in the bearish range in Q3, to retest the post-Brexit-referendum lows seen in January 2017.

Key events lie ahead. The Conservative Party leadership race will be held in July, with the final announcement on 22ndJuly. Boris Johnson, a leading advocate of leaving the EU, is the favorite to be the next prime minister but is expected to adopt a more hard-line approach to leaving the EU. The risk of a hard Brexit (or a no-deal Brexit) has thus increased.

The new Brexit date is 31st October. If the date is delayed again under a new European Commission starting 1st November, Brexit uncertainty will continue.

Well, all these macros standpoints could propel GBPAUD either on upswings or downswings but with slightly biased southwards.

Hedging Framework:

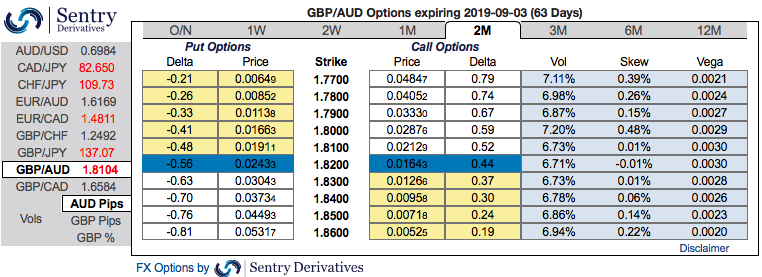

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

The execution: Initiate long in GBPAUD 2M at the money delta put, long 2M at the money delta call and simultaneously, Short theta in 1m (1.5%) out of the money call with positive theta or closer to zero.

Rationale: Contemplating 2m IV skews that are well balanced on either side (positively skews on both OTM calls and OTM puts), we reckon that the Delta instruments are conducive to monitor directional risk so as to be aware that how much of option’s value would increase or diminish as the underlying market moves as this option tool measures the value of an option as the underlying spot FX moves. Well, a higher (absolute) Delta value is desirable on the long leg in the above-stated strategy. Whereas, the Theta is positive on the short leg; as the time decay is good for an option writer (that’s why we’ve chosen narrowed expiry).

We reiterate, in the prevailing puzzled environment you could observe that the momentary bulls of GBPAUD have currently been trading in non-directionally but with some bearish pressures. Hence, we advocate the above hedging strategy with the cost-effectiveness that could hedge regardless of the swings on either side. Courtesy: Sentry & ANZ

Let’s glance at the FxWirePro’s Currency Strength Index: FxWirePro's hourly AUD spot index is flashing -69 (which is bullish), while hourly GBP spot index was at shy above -1 (absolutely neutral) at 07:03 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data