A revised Brexit deal was agreed by the UK and EU yesterday, but without the blessing of the DUP. European Commission President Juncker was on script with the UK government, playing down the possibility of another Brexit extension – media reports suggest this was an attempt to bolster support for the agreement in the House of Commons. A key vote is set to take place in a special sitting of the UK parliament on Saturday. The consensus is that this will be a very close, given DUP opposition and reliance on some Labour MPs as well as Conservative MPs who were opposed to the previous deal or recently expelled from the Party.

Aside from Brexit, UK interest will be on speeches from BoE Governor Carney and Deputy Governor Cunliffe this evening. Fellow MPC member Vlieghe, earlier this week, said that a Brexit deal may prevent the need for easier monetary policy, and would instead put ‘gradual and limited’ hikes back on the table. However, more stimulus is likely in the event of prolonged Brexit uncertainty or a no deal. That sentiment was echoed in comments by Deputy Governor Ramsden this morning.

The GBPJPY was volatile yesterday, appreciating to just shy of $141.50 at one point after reports of a Brexit deal agreement, but subsequently paring gains on uncertainty whether it will have the support of the House of Commons. Currently, trading at 139.63 level, still, it is well up from last week’s lows of around 130.431 levels. Sterling markets remain on tenterhooks ahead of Saturday’s vote, with Asian trading restarting on Sunday evening (UK time).

Even so we believe it worthwhile increasing our bearish beta to GBP through re-selling GBPJPY (our single most successful trade to date this year). The lead- up to the EU summit on October 17-18 will become increasingly fraught from a political perspective.

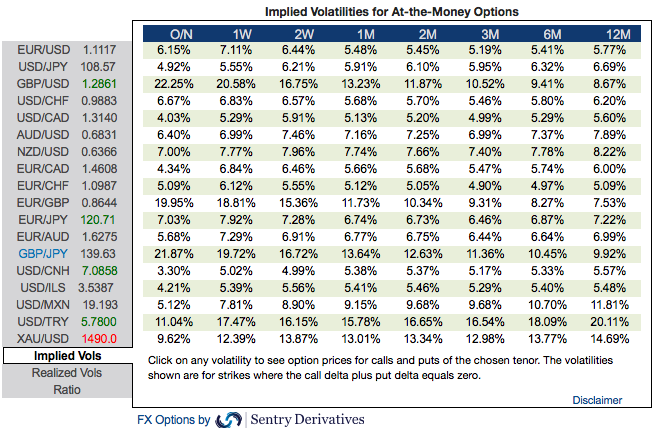

OTC outlook and Hedging Strategy: The implied volatility of this pair that display the highest number among entire G7 FX universe (see 1st nutshell).

While the positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes up to 135 levels (refer 2nd nutshell).

Accordingly, put ratio back spreads (PRBS) are advocated on the hedging grounds. Both the speculators and hedgers who are interested in bearish risks are advised to capitalize on current abrupt and momentary price rallies and bidding theta shorts in short run, on the flip side, 3m skews to optimally utilize delta longs.

The execution: Capitalizing on any minor upswings , we advocate shorting 2m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, go long in 2 lots of delta long in 2m ATM -0.49 delta put options (spot reference: 139.63 levels).

The rationale for PRBS: Well, the traders tend to perceive these trades as a bear strategy, because it deploys more puts. But actually, it is a volatility strategy.

Hence, entering the position when implied volatility is high and anticipating for the inevitable adjustment is a wise thing, regardless of the direction of price movement. Based on volatility and time decay, the strategy is a “price neutral” approach to options, and one that makes a lot of sense.

The position is a spread with limited loss potential, but varying profit potential. The degree of profit relies on the strength and rapidity of price movement. The position uses long and short puts in a ratio, such as 2:1 or 3:2, to maximize returns. Courtesy: Sentrix & Commerzbank

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close