Over the weekend, the Bank of Canada cut its key interest rate by another 50 bp, after it had lowered its key interest rate from 1.75% to 1.25% at its regular meeting. The BoC also said that it was ready to take further steps if necessary.

Not only does the impact of the covid-19 pandemic pose significant downside risks to the Canadian economy, but also the sharp drop in oil prices is likely to weigh on the Canadian economy. The coronavirus has not yet spread so strongly in Canada. But experience shows that this can change quickly. The pandemic is certainly noticeable. Tourism, retail, restaurants, entertainment: There are already significant cutbacks. Now the border is also being closed.

In view of the high level of uncertainty, it is therefore understandable that the central bank has confirmed its willingness to act if necessary. At the moment, it looks as if this will actually become necessary, so we expect a further interest rate cut at the latest at the regular meeting on April 15. The CAD should therefore remain under depreciation pressure and USDCAD should remain above 1.40.

While the market sentiment has been driving strictly defensive positioning we think that it is prudent to keep an eye on historic skew dislocations their theta-scalping via risk off ratio spreads (delta-hedged). Those are a class of structures that can efficiently monetize excessive risk premia in vol smiles. While ratios can be struck for both calls and puts, the recent vol episode pushed the pricing of risk of OTM strikes into uncharted territory and made of particular interest the structures where the short notional is placed on the “risk-off” side, i.e. selling risk-reversals. While such structures are quicker in collecting premium, exposure to left tail is notable.

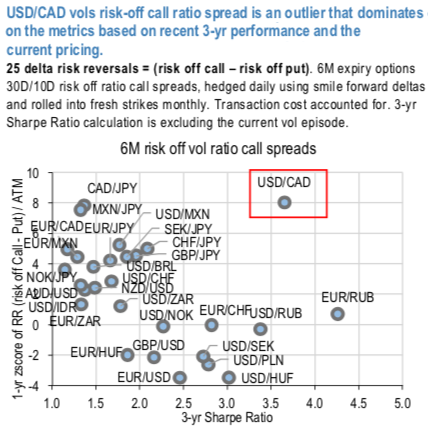

USDCAD vols risk-off call ratio spread is an outlier that dominates (refer above chart) where currency pairs are screened based on 3 year Sharpe (a medium term performance horizon) of risk off ratio vol spread structures and 1-y zscore of skew / ATM vol ratio.

3M USDCAD delta-hedged ATM/25D call spread @9.8/10.3indic vs 12.7ch, equal notionals to keep the structure net long vega. Courtesy: JPM & Commerzbank

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom