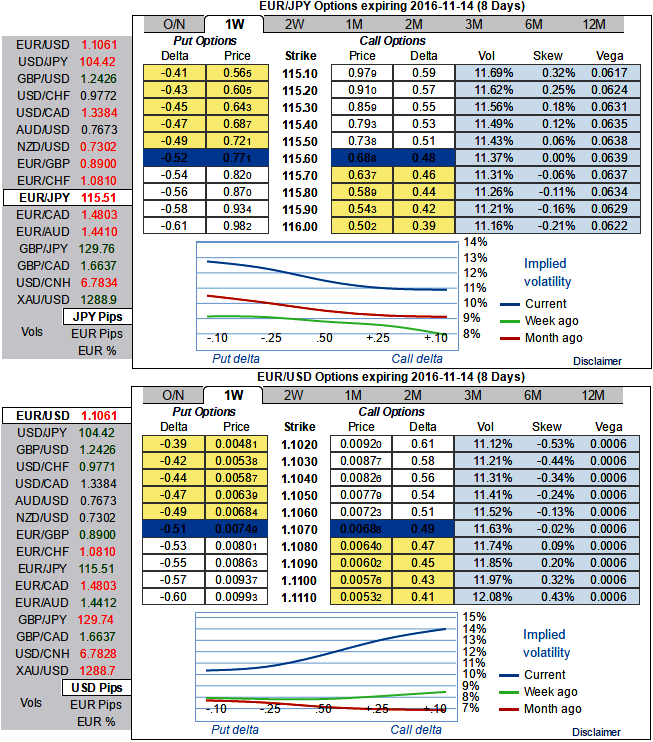

EUR/USD and yen options at each end of the G10 skew.

The revived US election risk created an unusual pattern seeing a weaker dollar combined with higher FX volatility, creating opportunities in skew space.

The US Presidential election looks set to be a close race. Although Hillary Clinton is ahead in most national polls, there is a swing toward Donald Trump in some key swing states.

A close contest means it may take some time before the result is known after polling is closed. A close result could also open the door to one of the candidates challenging the result.

As polling currently stands, Hillary Clinton is set to be the next US President and the power of the Congress divided.

JPY and EUR calls are now both in high demand, lifting JPY skews but pressuring EURUSD risk reversals.

The spread between EURJPY and EURUSD 3m risk reversals is now very elevated historically and we expect it to tighten.

It never reached 1.5 vols between 2012 and 2015 and such a situation happened only very transitorily this year.

Flat or positively skewed EURUSD towards OTM calls: not an anomaly but not sustainable. Such as pattern is indeed consistent with no correlation between spot moves and volatility changes, and this is exactly what is happening in the EUR/USD option market.

This correlation is usually negative, and we expect the US election to be dollar-friendly and to support volatility.

Short EURJPY rather than USDJPY skew. Yen calls are in high demand as the market is behaving in a risk-off way.

As we wrote here and here, yen strength probably met an inflexion point. The EURJPY 3m skew is larger than the USDJPY (-2.0 vs -1.7, mid) so that selling the former provides a higher premium.

1Moreover, the EURJPY skew exceeding the USDJPY is not consistent in times of EUR topside volatility.

On the contrary, euro bullishness should have dampened the EURJPY skew, which is an attractive short.

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?