In the recent past, we’ve been encountering the major tariff announcements and their impact on various walks of lives, overshadowing what was otherwise a meaningful week of macro data. The US-China trade tensions escalated dramatically, but the baseline remains a forthcoming renegotiation of the US-China relationship, now just with much higher stakes.

FX vols have been perplexingly soft over the past two weeks in the face of escalating trade war rhetoric and equity markets’ jitters have been the talking point de jour in FX option circles. Perhaps for this reason, FX has become desensitized as negotiations will take time.

In this turbulence of FX world, while hedging it would be wise to have a fair understanding of the driving forces that determine the option pricing before heading into the world of trading options. First, while IV is widely used to predict FX volatility, to the best of our knowledge

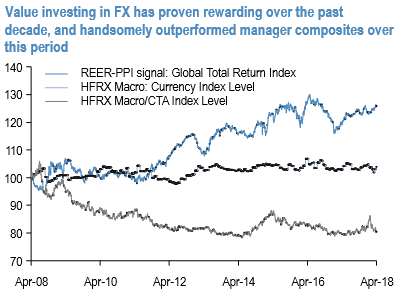

For an asset class widely considered to be a haven for trend following investors, fundamental value-based strategies in foreign exchange have performed commendably over the past decade.

The above chart plots the total return stream from holding monthly re-balanced long/short baskets of the most over-and under-valued currencies among a panel of G10 and EM FX based on the deviation of their PPI-based real effective exchange rates (REER) from 15-year moving averages.

A Sharpe Ratio of 0.4 from following this simple empirical over the past 10-years (including GFC) is nothing to be sneered at given the performance of comparable hedge fund manager composites over the same period.

If long-term value indicators have predictive power for future trend reversals in exchange rates, our interest from a volatility standpoint is to identify pockets where option markets grossly miscalculate the probability of such shifts and hence reward potential investors to enter into leveraged medium-term mean-reversion opportunities.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges