Last week Banxico increased the Fondeo rate 25bp as a pre-emptive hike to protect the MXN. With inflation running at historical lows and no demand pressures on sight.

We expect Banxico to deliver two more pre-emptive hikes but not to follow the Fed one-to-one thereafter (Mexico monetary policy: A pre-emptive hike and two more to follow, 17 December 2015).

Price action for the peso into year-end will likely be driven by oil prices and overall sentiment towards emerging markets.

Since Banxico hiked in the last meeting after the Fed - in order for "currency check" - we reckon that inflation should not be a relevant variable in the months to come as the board might continue to move in line with the Fed, at least at the beginning, to maintain a consistent policy stance.

In that sense, we expect two more hikes in March and June next year. The minutes due on December 31 should confirm this view.

On the eve of Christmas, this Latin American currency pair ended between 17.0319 and 17.3159 this week to spare US session aside, currently inched above 0.1749 on the session.

In earlier December, the Mexican peso fell to record-lows versus the dollar as the likelihood of a Fed rate hike became more apparent.

The peso is down by approximately 15% against its American counterpart this year and it is continue to remain in the same tredn, as investors flocked to safer assets north of the border.

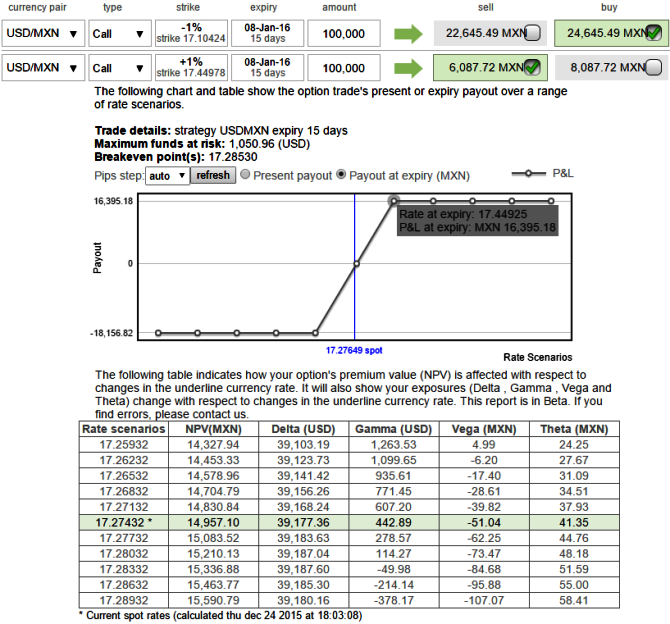

Hedging Strategy: It is advisable to buy 2W 1% ITM 0.71 delta call, while shorting 4D 1% OTM +0.12 delta calls with positive theta. You can strategy as explained in the diagrammatic representation, we've used identical expiries but prefer shorter expiries on the short side in real scenarios.

Be mindful of strategy should reflect combined delta more 0.35 at least so as to ensure the strategy not only reduces the cost of hedging but also hedges underlying outrights, An investor with a bullish mindset often deploys this strategy and wants to capitalize on a modest advance in price of the USDMXN.

An investor will also turn to this spread when there is discomfort with either the cost of purchasing and holding the long naked call alone, or with the conviction of his bullish market opinion.

Maximum loss for this spread will generally occur as USDMXN declines below the lower strike price.

If both options expire out-of-the-money with no value, the reduced net debit paid for the spread will be lost.

FxWirePro: Banxico’s pre-emptive hikes since 2008 reins the pace of USD/MXN bull-run – hedge with debit delta spreads

Thursday, December 24, 2015 12:52 PM UTC

Editor's Picks

- Market Data

Most Popular

3