- AUD/USD hit 4-week lows of 0.7855 as Aussie was dumped across the board on dismal retail sales and trade data.

- Australia retail sales dropped 0.5 percent in December, missing market expectations for a 0.2 percent drop.

- Further, the trade balance recorded a deficit of AUD 1.36 billion in December compared to the AUD 0.2 billion surplus.

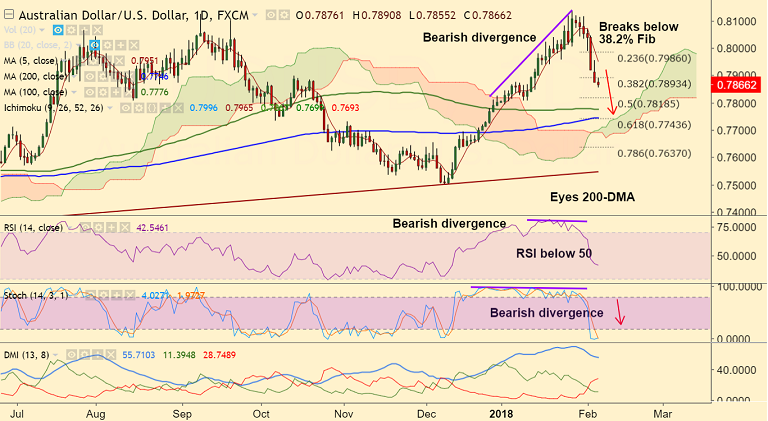

- The pair has broken support at 38.2% Fib at 0.7893 and we see scope for test of next major support at 0.7825 (200W-SMA).

- Violation there will see test of 0.7746 (nearly converged 200-DMA and 61.8% Fib).

- Technical studies are highly bearish, focus now on RBA monetary policy decision for further impetus.

- The RBA likely to stay pat, while commentary will be keenly watched for cues.

Support levels - 0.7825 (200W-SMA), 0.78, 0.7746 (200-DMA)

Resistance levels - 0.7893 (38.2% Fib retrace of 0.7501 to 0.8135 rally), 0.7952 (5-DMA), 0.7983 (20-DMA)

Recommendation: Good to go short on rallies around 0.7880/0.79, SL: 0.7985/ TP: 0.7825/ 0.78/ 0.7745

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.