Snippets of FED & USD projections: The US central bank has put an enormous aid programme for the fight against the corona crisis in place. Not only the volume is impressive but also the central banker’s reaction time has been quite something. As soon as any form of liquidity shortages emerge anywhere in the economy it would seem that almost at the same time the Fed passes aid programmes accordingly. Most recently it announced that it would extend the aid packages on a communal level to ensure that loans reach every corner of the US. However, it is still unclear how effective its measures are. As some of the lending programmes are not yet up and running it is likely to take a while before successes become visible. Not least for that reason we assume that the Fed will keep everything on hold at its meeting tonight and will refer to the measures passed so far.

However, the Fed’s liquidity measures are not limited to the US only. By extending its USD swap lines and creating a repo facility (FIMA) with foreign central banks it has also reacted to USD demand in other parts of the world. This has calmed the financial markets down significantly and above all stabilised USD exchange rates.

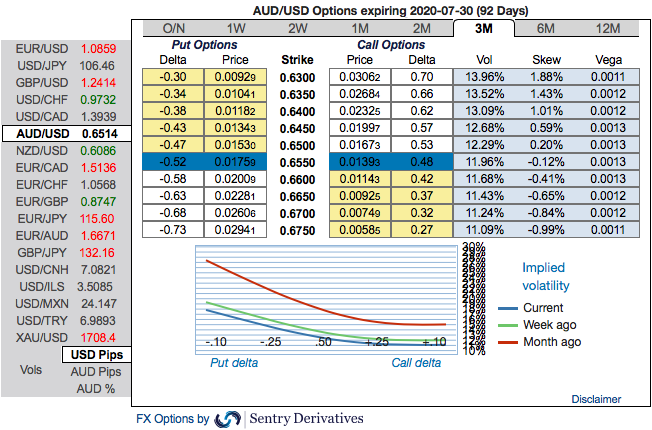

Snippets of RBA & AUD projections: As the dust settles on a remarkable month for markets, we have made some revisions to the trajectory for our AUD/USD forecasts. We see AUD/USD at 0.63 by mid-year (prior was USD0.64) but have lifted our year end forecast to 0.65 by year end (prior was USD0.60). As we wrote here, there are solid justifications for AUD’s recent out-performance, which in combination with constructive price action, has forced us to rethink the likely trading range for AUD/USD in 2020.

Since we last published in early March, the RBA has been very active. The RBA has cut the cash rate to 0.25%, announced a 3Y yield target and a term funding facility for banks. It has been purchasing government bonds in the secondary market to 1) achieve the 3Y yield target; and 2) to address market dislocations.

Hedging Dynamics: The positively skewed IVs of 3m tenors are also in line with the above predictions, they still signify the hedgers’ interests to bid OTM put strikes up to 0.63 levels (refer 1st chart).

Please also be noted that we see fresh bids for current bearish risk reversals (RRs) setup across all the longer tenors (refer 2nd chart).

In a nutshell, AUD OTC hedgers’ sentiments substantiate that their risk mitigating activities for the further downside potential has been clear.

Diagonal debit put spreads have been advocated about a fortnight ago (precisely on 6th April) so as to mitigate the potential downside risks with a reduced cost of hedging.

The combination of AUDUSD’s short-term higher potential amid lower IVs was luring the OTM put options writing. While the medium-term perspective is attractive for bearish hedges via ITM puts.

The options strategy reads this way: short 2w (1%) OTM put option with positive theta (position functioned as per the expectations as the underlying spot has rallied considerably), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options. We keep reiterating that the deep in the money put option with a very strong delta will move in tandem with the underlying spot FX.

Alternatively, we advocated shorting futures contracts of May-month deliveries. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position. Courtesy: Sentry, JPM & Saxo

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms