We have BoE scheduled for its monetary policy announcement in this week, we take a look a look at the policy outlook and the implications for the economy. The MPC is not anticipated to publish any inflation forecast at the two-year horizon that is much different from the 0.1ppt overshoot of the 2% CPI target presented in August.

In August, the Bank Rate of BoE was lifted to 0.75%. The market does not expect that the Bank Rate would be hiked until late next year, even though there seems to be high uncertainty about the exact timing of the hike, the right-hand chart below. This corresponds well with our long-held forecast, pointing to a hike in November 2019. We anticipate that the present guidance; i.e. that hikes will continue at a gradual pace and to a limited extent, will be maintained at this meeting. In addition, the BoE may indicate how monetary policy could respond to a no-deal Brexit.

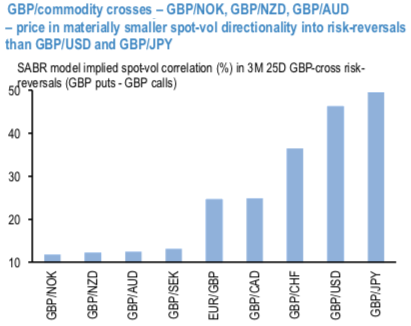

The 1stand 2ndchartsexhibit that even if one were to completely shun non-mainstream GBP-crosses, a conventional pair like EURGBP is still available as a better priced risk-reversal alternative to GBPUSD. The simple reason is that option markets remain loath to de- price Italian risks out of Euro-crosses, with the implication that EUR puts/GBP puts are better bid vis-à- vis EUR calls/GBP puts than would have been the case otherwise.

Onto other crosses.

3rdchartplots monthly return betas of GBP put options across G10 vis-à-vis those of GBP puts/USD calls over two sub-samples: a) all months when GBPUSD put returns were positive, and b) May- June of 2016 around the Brexit referendum. As anticipated, GBPCHF and GBPJPY have the highest median betas to GBPUSD (and even then, less than 1); GBPCAD and GBPNZD are interesting mid-table entries that rank ahead of even a liquid GBP-cross such as EURGBP. The even more noteworthy numbers are the return betas around the Brexit referendum event: GBPNZD, GBPAUD and to a lesser extent GBPCAD puts were the standout performers on that occasion, in part because GBP-weakness remained a localized event without broader risk market spillovers, and partly due to benign option pricing, ostensibly for similar reasons that their riskies are subdued today. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -101 levels (which is bearish), while hourly GBP spot index was at -71 (bearish) while articulating (at 14:07 GMT). For more details on the index, please refer below weblink:

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated