The Japanese yen has been falling modestly possibly due in part to expectations of BoJ that is scheduled for mid of this month (20th Dec). Sterling is sitting close to recent highs ahead of next week’s BoE’s monetary policy announcement (14th Dec) and Brexit: no deal yesterday, goal to reach compromise by mid-December, the status of Irish border divides DUP/ Conservative government, GBP bulls cave in, cable at 1.3440, 2y/10y IRS steepens to 51bp.

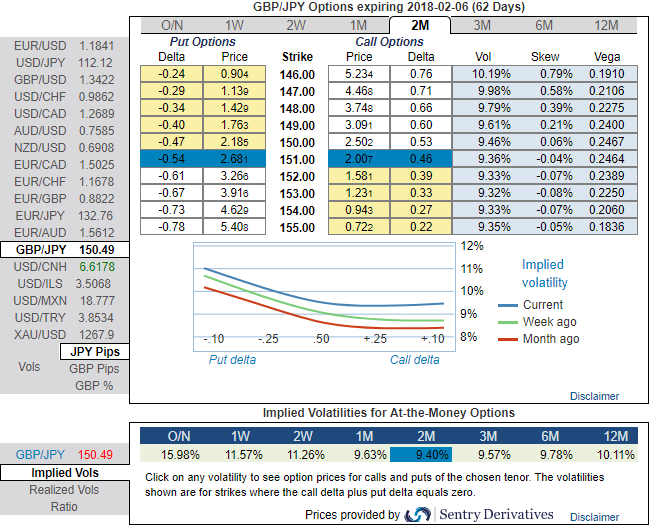

Please be noted that the positively skewed IVs of GBPJPY of 2w/1m tenors signify the hedgers’ interests in OTM put strikes. While IVs of these tenors are spiking above 11.25% & 9.60% which is highest among G7 Fx bloc.

The higher IVs with well-adjusted positive skewness signify the hedgers’ interest for both OTM call/put strikes. In usual circumstances, long option position needs higher IVs for significant change in vega. Hence, we capitalize on buzzing IVs and improve odds on options below strategy.

With this interpretation, one can judge whether the options with a higher IV cost more. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favour. If IV increases and you are holding an option, this is good.

Thus, we advocate weighing up above aspects as we eye on loading up with fresh vega longs for long term hedging, more number of longs comprising of ATM instruments and deep OTM call shorts with narrowed tenors would optimize the strategy.

The aggressive volatility investors want to capture GBP should consider buying ATM put instruments and/or being long of the smile convexity, against ATM volatility. Please glance through sensitivity table for the ATM and OTM pricings, ATM puts are trading at 10.66% and OTM puts are at 30.6%. Thus, ATM strikes are perceived to be more conducive than the OTMs.

Further GBPJPY upswings and/or weakness suggest building a directional strategies and volatility patterns at the same time.

In order to mitigate downside risks and keep them on the check, we advocate adding longs in 2 lots of ATM -0.49 delta puts of 1m tenor while writing 1 lot of 2% OTM put of 1w tenor.

Contemplating IV skewness and ongoing technical trend, we foresee the value of ATM options would likely rise significantly as the IVs seem to be favoring long legs of ATM strikes.

Currency Strength Index: Ahead of the announcement of the UK retail sales numbers and BoJ’s monetary policies, FxWirePro's hourly GBP spot index is flashing at -143 levels (highly bearish), while hourly JPY spot index was at shy above 20 (neutral) while articulating at 07:41 GMT, these indies values are also in sync with our above technical rationale. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated