AUDUSD bulls, in the short-run, show some minor support at 0.7170-80 region, however, the pair appears to be vulnerable given the risk averse mood globally.

The medium-term perspective: Australia’s poor GDP data was a notable setback to the domestic story but aside from forecast adjustment in Feb, the RBA is unlikely to change its tune, limiting AU yield downside. Commodity prices suggest AUD should be 0.7350 - 0.7400 levels but a very sour global risk environment will cap rallies. If the Fed enters 2019 still planning hikes, AUDUSD should head back to 0.69-0.70 levels in Q1 2019.

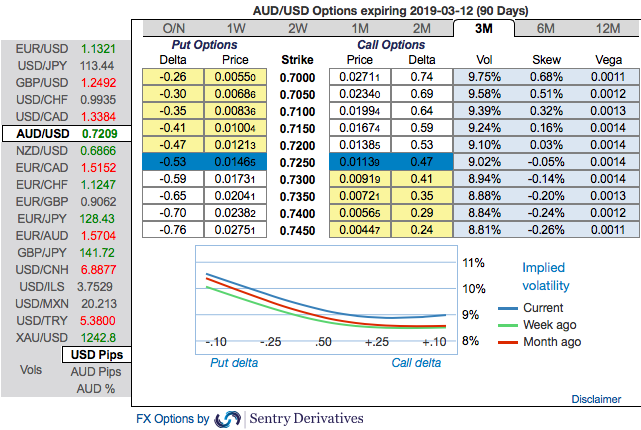

OTC outlook and Hedging Perspectives (AUDUSD):

Before proceeding further into the strategic framework, ahead of RBA's monetary policy minutes and Federal Reserve's hikes that are sheduled for next week, let’s just quickly glance through the positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes upto 0.70 levels which is in line with above projections (refer above nutshell). While positive shift in risk reversals of short-term tenors are in sync with momentary upswings in the underlying spot fx, bearish delta risk reversal across all tenors also substantiate that the hedging activities for the downside risks, refer 2nd (RR) nutshell.

Accordingly, we have advocated delta longs for long term on hedging grounds, more number of longs comprising of ITM instruments and capitalizing on prevailing rallies and shrinking IVs in 1m tenors, theta shorts in short-term to optimize the strategy.

Theta shorts in OTM put option would go worthless and the premiums received from this leg would be sure profit.We would like to hold the same option strategy as stated above on hedging grounds. Thereby, deep in the money put option with a very strong delta will move in tandem with the underlying.

The execution of hedging strategy:Short 1m (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options. A move towards the ATM territory increases the Vega, Gamma and Delta which boosts premium. Courtesy: JPM, Sentrix and Saxo

Currency Strength Index:FxWirePro's hourly AUD spot index is inching towards 13 levels (which is neutral), hourly USD spot index was at 122 (bullish), while articulating (at 08:55 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025