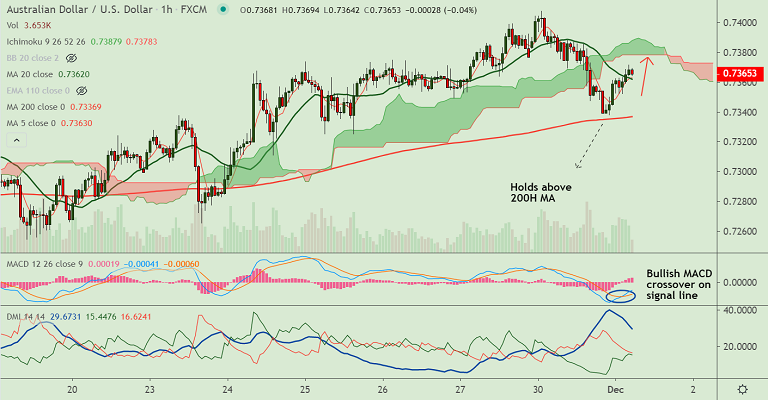

AUD/USD chart - Trading View

AUD/USD has erased a large part of previous session's losses and was trading 0.37% higher on the day at 0.7367 at around 05:00 GMT.

At its December monetary policy meeting this Tuesday, the Reserve Bank of Australia (RBA) left monetary policy settings unchanged, as expected.

The RBA board members decided to maintain the official cash rate (OCR) at a record low of 0.10%, and its three-year bond yield target unchanged at 0.10%.

Further, activity in China’s factory sector accelerated at the fastest pace in a decade in November, a business survey showed on Tuesday.

The Caixin/Markit Manufacturing Purchasing Managers’ Index(PMI) rose to 54.9 from October’s 53.6, beating analysts' forecast for a dip to 53.5.

Details of the report showed gauges of both total new orders and factory output marked 10-year highs. New export orders rose more modestly.

AUD/USD trades with a bullish bias. Price action consolidates above 200W MA and resumption of upside will see test of 78.6% Fib at 0.7573.

Focus now shall be on Fed Chair Powell’s testimony and the US economic data for fresh impetus.