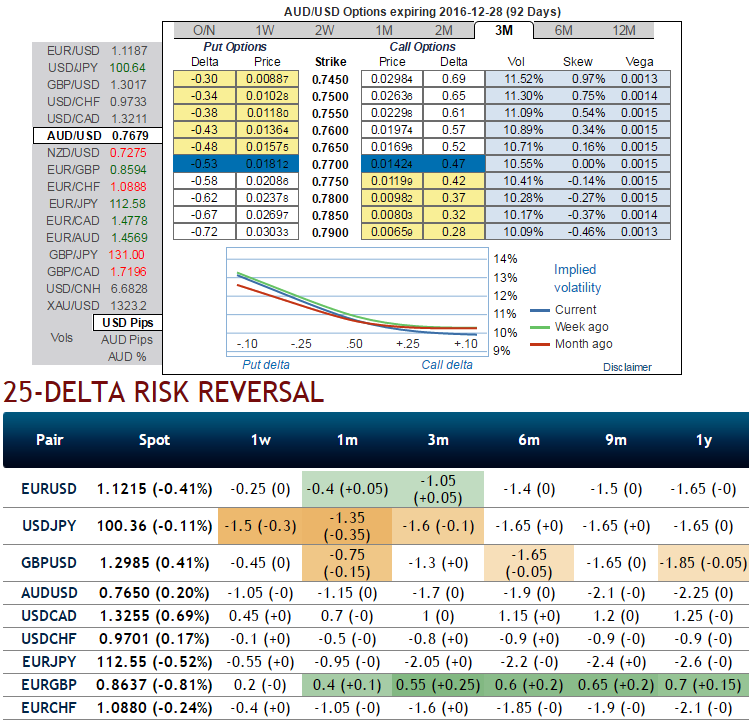

Please be noted that the skewness in implied volatility of 3m tenors of this pair signifies the hedgers interest in OTM put strikes.

While delta risk reversals of the similar expiries reveal more sentiments in hedging activities for downside risks. This would raise a cause of concern that in this phase of time, the major economic events are likely to intensify volatility in FX markets.

Hence, we could foresee AUDUSD’s direction below 0.72 in the months to come, given:

(1) The RBA easing cycle becomes more aggressive, as domestic growth slips;

(2) China growth forecasts are cut materially, or the pace of slowing accelerates; or

(3) The carry trade unwinds in response to a rise in G3 bond yields.

(4) A retracement in commodity prices should cap AUDUSD.

(5) Hopes on Fed’s rate hike during December.

Monetary policy drivers take a back seat for AUD in coming months. With the RBA now on hold for the remainder of 2016 (having cut rates by 50bp in Q2/Q3 in response to an inflation shock).

The Fed likely to be on hold until late in Q4 once money market reforms and the Presidential election are out of the way, it is hard to argue that monetary policy expectations will have much of an effect on AUDUSD in coming months.

Indeed, the recent compression in front end rate differentials as the RBA has cut rates has had little impact on AUDUSD of late, suggesting that the level of front end rates – and expectations about the path of front end rates – have had less influence on AUD than historical experience would suggest.

Contemplating the above fundamental as well as OTC factors, we construct strategy comprising of both calls as well as puts in the ratio of 3:1 so as to suit the swings on either directions.

Capitalizing on lower IVs we eye on shorting at the money calls with shorter expiries which would lock in certain yields by initial receipts of premiums and risk reversals to favour longs in puts in lengthier tenors.

Well, here goes the strategy, go short in 1m OTM calls and simultaneously, 3 lots of 3m puts (+1% ITM, ATM and +1% OTM strikes) are preferred to suit the prevailing losing streaks. So thereby the combination would be executed for net debit and the cost is reduced by short side.

Moreover, the strategy could be counterproductive as the skews in 3m IVs favours OTM puts strikes.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty