Despite the breakdown in trade talks between the US and China at the end of last week, which saw the US increase tariffs of $200bn worth of Chinese goods to 25%, broader market sentiment seems to have stabilized. US equities are finding buying interest on the current pullback, while the USD vs G10 remains in its short-term range.

EURUSD bulls are extending weekend rallies today but the prices seem to be coming back under pressure at 1.1241 (i.e. day highs). Our analysis has been more positive in the last few days, but prices have stalled under 1.1265. As such, a move through here and then 1.1330 is needed to add conviction that a base has developed at 1.1112 for a move towards the range highs. Such a break should allow for a further test of the 1.1450 and 1.1570 key resistance levels. A slide back through 1.1200-1.1160 would negate some of the basing structures and risk another new low, possibly after some further range trading.

Overall, on a broader perspective, the prices are within our long-term 1.1200-1.0800 basing region, we still have little evidence of a base developing. A rally back through 1.1315 would be a start, but 1.1450 and 1.1570 are further important hurdles in that process.

Option Strategy: Options Strips

Combination ratio: (2:1)

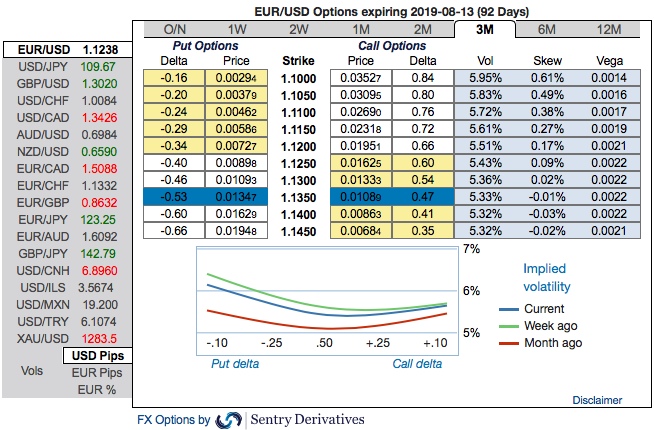

The execution: Initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 3M tenors, go long 1m at the money +0.51 delta call option simultaneously.

The strategy can be executed at net debit with a view to arresting FX risks on both sides and likely to derive exponential returns but with more potential on the downside.

Rationale: Please be noted that the positively skewed IVs of EURUSD of 3m tenors signify the hedging interest of bearish risks (bids for OTM put strikes up to 1.10 levels).

To substantiate this stance, the negative risk reversals across all tenors also indicates bearish risks remain intact in the major trend, while positive bids indicate mild upside risks in the short-run.

Well, contemplating above-stated driving forces and OTC indications, options strips strategy is advocated on both trading as well as hedging grounds. The options strips strategy which contains 3 legs needs to be maintained with a view to arresting price downside risks.

Considering the bullish (in near-term) and bearish technical environment (in long-term) and most importantly, the skews in the sensitivity tool indicate hedging sentiments for the bearish risks, these risks are coupled with bearish risk reversal numbers. Courtesy: Sentry, Saxo & Lloyds banks

Currency Strength Index: FxWirePro's hourly EUR spot index is showing 78 (which is bullish), while USD is flashing at -88 (which is mildly bearish), while articulating at (10:35 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?