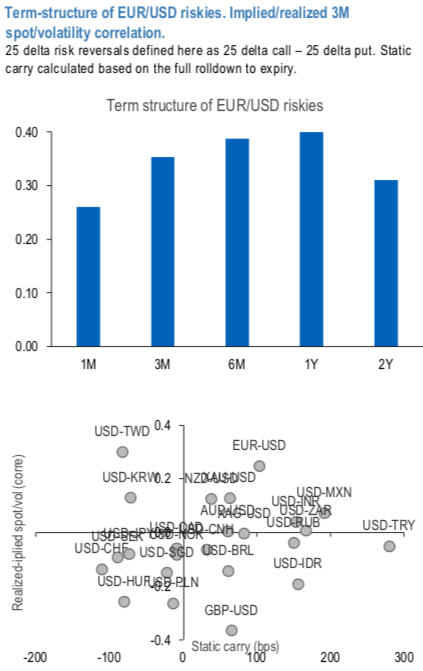

The term structure of EURUSD riskies structurally points to a premium for buying EUR topside (refer top chart in 1st diagram). The static carry of the structure benefits from the tight level of riskies (most attractive ones, 2y) and positive forward points associated with the short EURUSD forward position.

However, while the year-end target from FX strategy team still points to strategic upside on the Euro, the performance of such dynamically delta-hedged construct would depend on the joint dynamics between spot and volatility, playing for a rise of the vol during EURUSD rallies; recent research (Long USD skews and correlations offer room for playing Coronavirus hedge trades) suggests that, in risk-off markets, USD dynamics is still consistent with a safe-haven status, which, coupled with the tight levels of USD skews, supports owning (rather than selling) the latter from the spot/vol correlation perspective.

The scatterplot (refer bottom chart in 1st diagram) combines two common metrics, both backward looking: realized-implied spot-vol correlation and static carry. For CHF, MXN, INR and ZAR skews the skew premium setup is conducive, while BRL riskies are still lagging despite cheap pricing and coronavirus-induced risk off markets. Skew performance spiked higher in KRW and TWD on the back of the recent events but the static carry is unfavorable. EUR calls are performing, while also supported by the static carry.

We expand the analysis with 2nd diagram, for supplementing the ex-ante appeal properties with actual long-term performances, a comparison which highlights the challenges of timing the entry into long riskies positions.

The nutshell in the diagram shows some 10y performance measures related to the ownership of riskies (long calls / short put, 3M 25-delta, vol costs included) for USD-crosses. From this long-term analysis, long EURUSD and USDINR delta-hedged riskies display decent performance measures; based on the table, buying CHF calls and selling USD calls worked well historically. Over the past couple of years, the performance of several USD/Asia riskies has delivered flattish PnL, which, coupled with current attractive pricing, should boost the interest for such defensive structures.

The bottom chart of 2nd diagram shows the time series of the static carry for EURUSD, EURINR and USDINR, in all three cases well positioned in positive territory. While the setup looks supportive for buying INR skews, a caveat might be related to the inclination of the Central Bank to control volatility, an issue that can be circumvented (at least to some degree) by playing long-dated tenors, as we do here.

Hence, consider,

Buy 2Y EURUSD risk-reversal (EUR calls – EUR put) @0.275/0.425 indicative, dynamically delta-hedged.

Buy 1Y USDINR risk-reversal (USD calls – USD put) @1.35/1.45 indicative, dynamically delta-hedged.

Buy 1Y USDCHF risk-reversal (CHF calls – CHF put) @1.0/1.2 indicative, dynamically delta- hedged. Courtesy: JPM

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand