The United States' Federal Reserve will declare the decision to unwind its balance sheet at the September FOMC meeting, followed by an implementation from November or December, reported DBS Group Research.

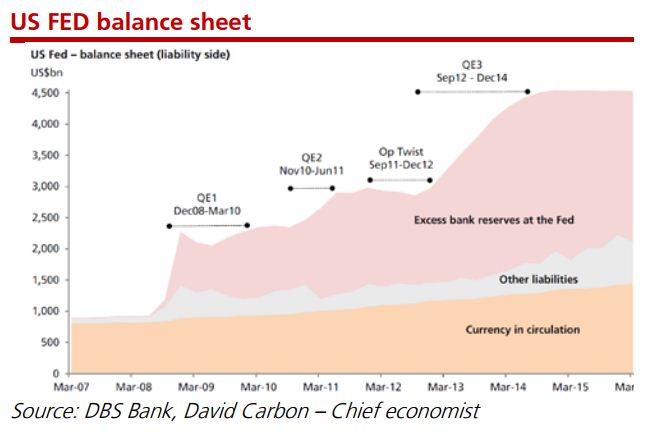

While the QE injections added up to over USD 3.6 billion posts the global financial crisis and the genuine effect on treasury yields and liquidity withdrawal from the economy are substantially lesser than what the figure proposes. Initially, most investigations have put the effect of QE on 10-year treasury yields (at present at 2.3 percent) at any place between 20-40bps.

Besides, approximately 90 percent of the USD 3.6 billion of QE money went straight into the FED's cellar in the form of excess reserves held by banks instead of being "infused" into the economy. So the FED purchased USD 3.6 trillion worth of bonds (and other longer-term resources) and paid for them with short-term stores at the FED itself.

Economists' at DBS research think that as QE did little good and little harm on the way in, it should be equally benign on the way out. He has also lowered his FED funds rate forecast with just another one hike in December this year (down from two hikes) following by four hikes in 2018.

Although this write-up is about August, we look further ahead at several important events in September that may result in a jittery equity market this month. Investors could capitalize on the latest rally to pare down equity exposure ahead of these developments. The first is a confluence of central banks’ policy meetings – the FED, ECB, and the BOJ. We expect the FED to hold rates steady at the 19-20 September FOMC meeting but may announce the commencement of its balance sheet reduction. In Europe, the ECB is expected to make a decision on whether to extend or wind-down asset purchases in 2018 at its policy meeting on 7 September, DBS noted.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed