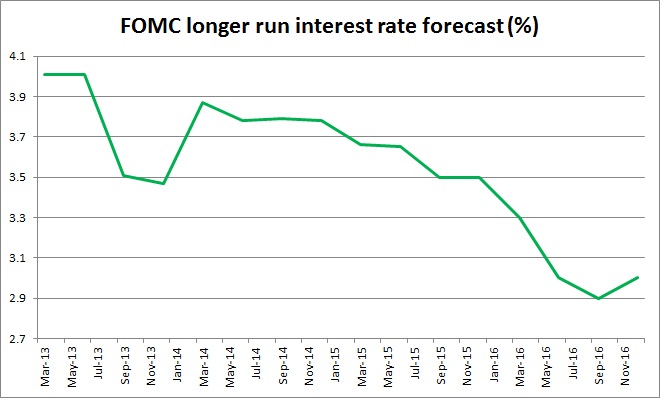

The above chart shows, how the longer run interest rate forecast by the Federal Open Market Committee (FOMC) has evolved since 2013. Last night the Fed announced a hike of 25 basis points in the Federal funds rate and released fresh economic and interest projections. While the future interest rate projections received an upgrade, it is not a uniform one.

- Fed’s interest rate forecast for 2017 rose by 40 basis points, whereas for 2018, it rose by 20 basis points and by 30 basis points for 2019.

- In comparison, the longer run federal funds rate rose by just 10 basis points. However, yesterday’s forecast was the first upgrade in the longer run interest rate projection since March 2014.

Judging from the interest rate forecasts, it would be fair to say that the Fed remains cautious. Back in early 2014, the FOMC was forecasting a longer rate of 4 percent and the current projections are 100 basis points below that and we are three years ahead of that forecast.

We suspect that only a steady return to inflation would make the forecast and the path steeper.

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed