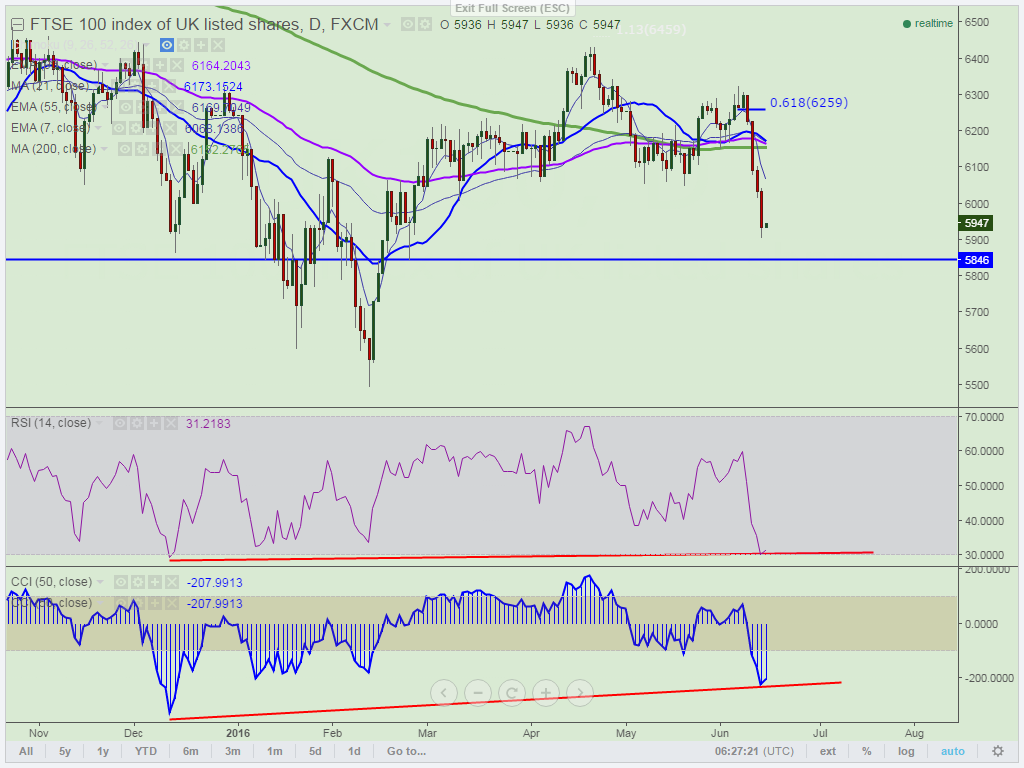

- Pattern formed – Bullish divergence (CCI (50) and RSI (14)

- Potential Reversal Zone (PRZ) – 5,845 (Feb 24th 2016)

- The index has recovered yesterday after making a low of 5,906 yesterday. It is currently trading around 5,945.

- Short term trend is slightly bullish as long as support 5,845 holds. Any further weakness can be seen only below 5,845 level.

- On the higher side minor resistance is around 6,000 (hourly Kijun-Sen) and any indicative break above targets 6,052 (55 H EMA)/6,108 (7 day EMA).

- FTSE100 is facing strong support at 5,845 and break below targets 5,732/5,600.

- In daily chart CCI (50) and RSI (14) has formed bullish divergence pattern .So a slight jump is possible.

It is good to buy at dips around 5,925-5,930 with SL around 5,845 for the TP of 6,050/6,105