The US Federal Reserve raised key interest rates by 25 basis points to between 0.50 per cent and 0.75 per cent on Wednesday in its second such hike since last December. The FOMC expects that with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market conditions will strengthen somewhat further.

Fed forecast of GDP growth next year was nudged only very slightly higher (up 0.1ppt to 2.1 percent), while that for unemployment was nudged only slightly lower (down 0.1ppt to 4.5 percent), and the forecasts for headline and core inflation were left unchanged (1.9 percent and 1.8 percent respectively). Minimal changes were made to future years' forecasts.

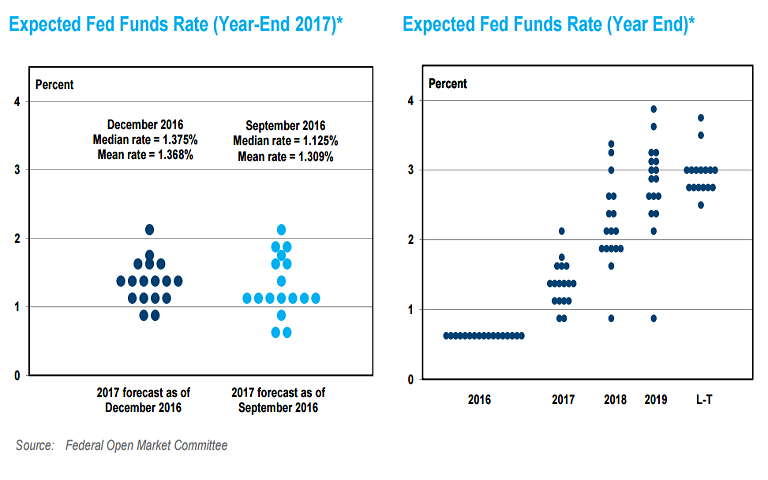

Fed's updated forecasts suggest that the FOMC hardly thinks that much has changed from three months ago. At the press conference, chair-person Yellen also noted that some FOMC members assumed fiscal stimulus over the coming year. When the Fed in December 2015 moved for the first time since the financial crisis, it projected four rate hikes in 2016, which did not materialize.

President-elect Donald Trump has pledged to cut taxes for corporations/individuals and to invest about $1 trillion on infrastructure. Trump's proposals are still uncertain, meaning that the Fed is unlikely to capture the full extent of their impact in its outlook right now. Recovery is likely to continue barring no major shock to the system. But the eventual performance of the economy is highly dependent on the still rather uncertain Trumponomics.

"We expect the Fed to hike rates slightly faster in 2018 than earlier anticipated. Overall, we expect real GDP growth of around 2% in 2017 and 2018. Risks to this outlook are significant. A more adverse policy mix including a more disruptive trade policy could lead to a significant economic slowdown. Fiscal policy, on the other hand, might prove more expansionary than we have assumed." said Nordea Bank in a report.

The USD surged higher, aligned with US yields on the back of the Fed's more than expected hawkish statement. USD/JPY surged past 118 handle to hit fresh 10-month highs at 118.66. EUR/USD plunged to hit fresh 13-year lows at 1.0405.

FxWirePro's Hourly USD Spot Index was at 156.292 (Highly bullish) at 1210 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary