At the peak of the crisis, unemployment in U.S. was hovering around 10%, which is clearly not being considered as healthy and Federal Reserve has taken unprecedented steps in monetary policy easing to tackle the unemployment, since dual mandate of FED includes maximum employment possible under price stability. Unemployment rate in Euro zone currently stands at 11.1%.

However on the other hand European Central Bank (ECB) has also taken up unconventional policy easing but at the sake of fragmentation.

However, without any central co-ordination from the fiscal side ECB alone is unlikely to succeed even if it wants to lower unemployment.

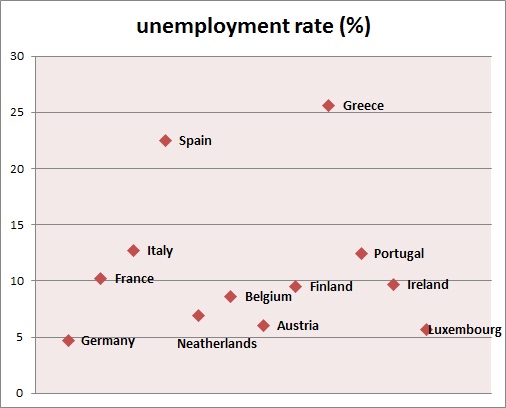

As of now, it is quite clear from the unemployment rate that Euro zone is far away from economic activities which can be labelled as normal.

European Central Bank (ECB) and fiscal authorities need not only to focus on monetary policy fragmentation but employment fragmentation.

- As of latest report, unemployment rates are extremely fragmented. While unemployment rate is at 4.7% in Germany, 5.5% in Malta, 5.7% in Luxembourg, 6% in Austria, rates are way higher in France (10.2%), Italy (12.7%) and Spain (22.5%). We are not even talking Greece and youth unemployment.

Unless this issue is tackled, Euro zone will keep facing challenges from Euro-skeptics, who are clearly on the rise across Europe.

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals