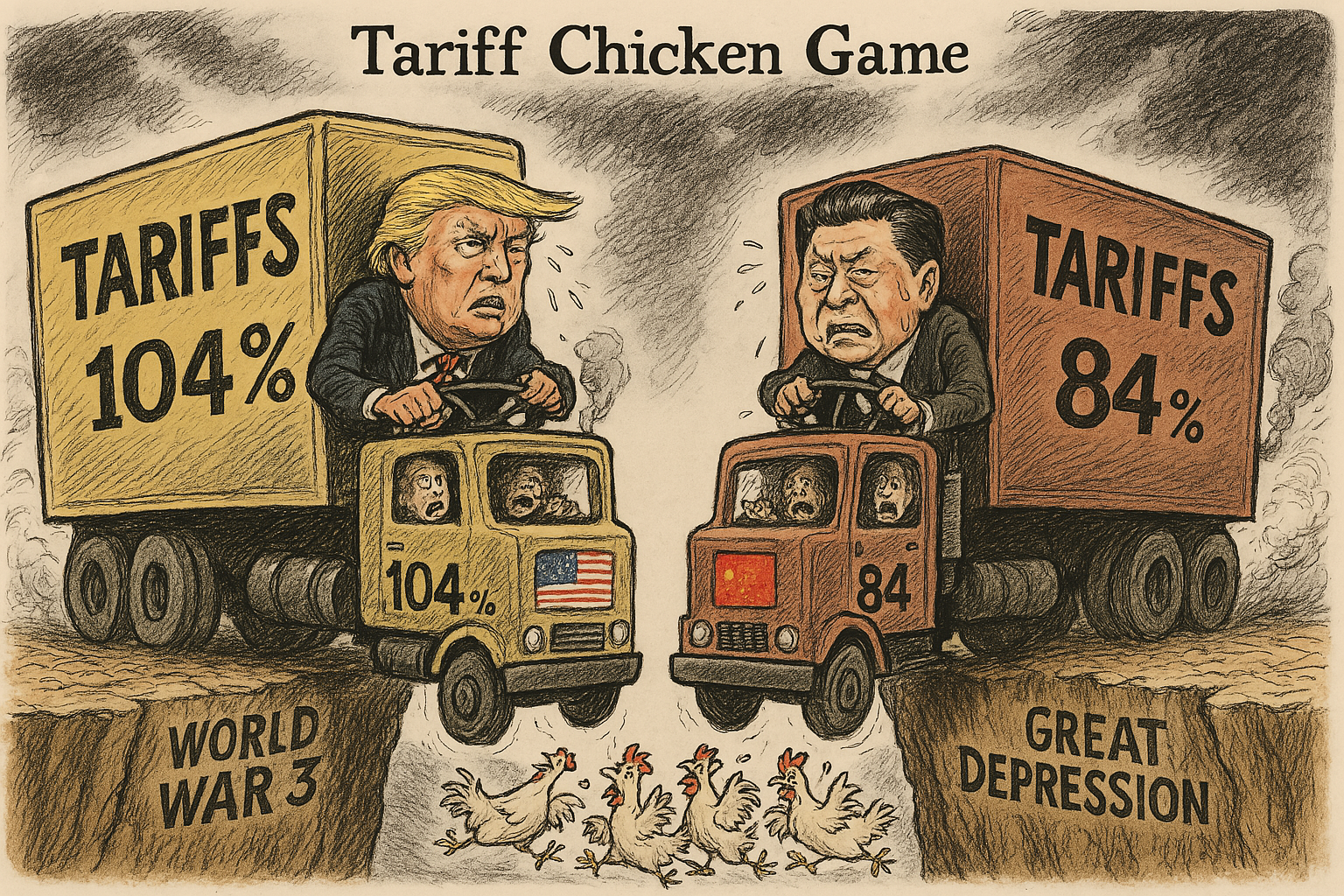

Amid rising tensions in the U.S.-China trade war, this week’s editorial cartoon depicts a dramatic “chicken game” scenario, where two economic superpowers appear locked in a collision course with potentially devastating global consequences.

In the illustration, U.S. President Donald Trump and Chinese President Xi Jinping are shown driving massive trucks labeled “TARIFFS” directly toward one another. Emblazoned on the vehicles are the stark figures “104%” and “84%,” symbolizing the steep tariffs recently announced by both countries. The road they travel leads to the edge of a cliff—ominously marked “WORLD WAR 3” and “GREAT DEPRESSION.”

Both leaders grip the wheel with sweat-streaked tension, unwilling to yield, while their panicked aides scream from the passenger seats. The metaphor is clear: this is not just a dispute over trade policy—it is a full-scale confrontation with global ramifications.

The image underscores how the tariff war risks spiraling far beyond economic retaliation. With global inflation, disrupted supply chains, and rising geopolitical instability already shaking markets, a full-blown escalation could lead to a scenario as catastrophic as a third world war or a repeat of the 1930s Great Depression.

The cartoon poses a sobering question: Who will blink first? But more importantly, it asks—if no one backs down, is there even a winner in this game?

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Markets Steady as Fed Signals Caution on Rate Cuts

Markets Steady as Fed Signals Caution on Rate Cuts  Teladoc Shares Rise on Amazon Collaboration for Health Programs

Teladoc Shares Rise on Amazon Collaboration for Health Programs  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Global Currency Shifts After BOJ Rate Hike and Trump's Tariff Comments

Global Currency Shifts After BOJ Rate Hike and Trump's Tariff Comments  Apple Loses Top Spot in China's Smartphone Market Amid Rising Competition

Apple Loses Top Spot in China's Smartphone Market Amid Rising Competition  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Equities Face Uncertain Outlook in 2025 Amid High Valuations and Risks

Equities Face Uncertain Outlook in 2025 Amid High Valuations and Risks  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out