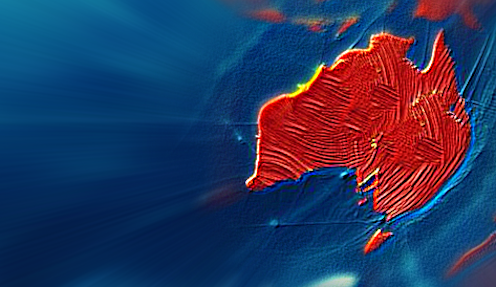

Australia has long thought of itself as the lucky country.

Whenever its economy has started to falter, a commodity boom has usually come along to restore prosperity… until in the 1980s, when the rest of the world failed to rescue us, and we embarked on a decade of reform.

I am afraid the world is going to fail to come to our rescue once again, and this time it’ll be harder to get a boost from reform because the easy reforms have already been done.

Here’s how I see our history from the earliest days of colonisation.

Exports kept making Australia rich

For most of those two or so centuries, we have been a commodity exporter, at first specialising in wool and wheat (mainly for the United Kingdom) and later specialising in minerals (initially for Japan).

We had to shift our focus quickly when the United Kingdom joined the European Economic Community in 1973.

Fortunately for us, Japan had surpassed the United Kingdom as our biggest customer the year before, in 1972, as our exports of minerals built steadily following the Australia-Japan Commerce Agreement signed in 1957.

Taiwan and South Korea later emulated Japan, buying our coal, iron ore and bauxite to modernise their cities as well as for manufacturing.

Demand for these commodities kept building until the late 1970s when it slowed as the East Asian economies matured.

Then came economic reform, and China

Demand stayed subdued throughout the 1980s and 1990s as Australia got on with economic reform, boosting the economy by letting in foreign banks, floating the dollar, cutting tariffs, removing cosy regulations and privatising enterprises in fields as diverse as airlines, airports, banking, telecommunications and energy.

By the early 2000s, China was a member of the World Trade Organisation and began demanding Australian iron ore and later coal and education, and the old pattern of commodity booms repeated itself, except this time bigger.

The usual pattern is growth in demand for Australian resources followed by a boom in foreign investment to develop those resources that pushes up the value of the dollar and boosts Australia’s buying power but makes its other exports less competitive.

When demand for resources falls, as is about to happen as China’s economy matures, Australians need to tighten their belts.

That’s unless Australia can find another big market or unleash another wave of economic reform.

China is a hard act to follow

China’s size makes the export boom we have just had hard to repeat. India has the population and an infrastructure deficit, but more of its own resources, and a more inward-focused growth strategy.

Indonesia has strong growth prospects, but faces challenges investing in infrastructure at scale in its densely populated chain of islands. And Australia faces competition from other commodity exporters. To keep prices high we need global demand to at least keep pace with potential supply.

Yet the International Monetary Fund is downgrading its global growth forecasts.

Geopolitical tensions, rising populism and protectionist sentiments, high debt levels and rising rates of natural disasters and climate-related disruptions are all downside risks for global growth, and, with this, the demand for commodities.

The one bright spot is the minerals needed for the energy transition, where demand exceeds forecast supply.

But Australia has many competitors in the supply of many of these minerals, and we failed to get a head start on the clean energy approaches to processing that would have given us an early advantage.

We’ll need reforms, but more subtle ones

So what are our options?

The reforms of the Hawke and Keating governments are still with us, but the declining role of government in the production of goods and services and a generally light-handed approach to regulation seems to have failed to prevent a decline in competition and, with it, a decline in economic dynamism.

While some of the government’s own actions might have dampened competition, it is entirely possible that the government’s withdrawal from all sorts of markets might be allowing those markets to become more concentrated.

It might even be that the government needs to change course again and reenter or better regulate some markets in order to force providers to lift their games.

While renationalisations are neither viable nor sensible, the energy transition and the projected growth of the care sector offer opportunities to reconsider the balance between the roles of government and the private sector.

The recently-announced Competition Review chaired by Kerry Schott is a step in the right direction.

The right solutions might be more subtle than those that worked in the 1980s. None of them should be off the table.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm