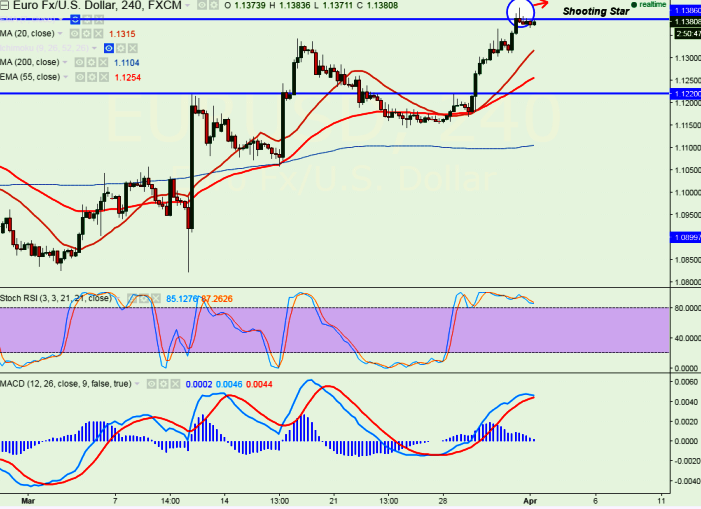

- Major resistance -1.4375

- The pair has made a high of 1.4117 and slightly retreated from that level. It is currently trading around 1.13802.

- Short term trend is slightly weak as long as resistance 1.14375 holds.

- Market awaits US Non Farm Payroll data which is to be released for further direction.

- US NFP is expected to show 208k growth in March compared to 242k in Feb and unemployment rate to be unchanged at 4.9%.

- Any break above 1.14375 will take the pair to next level around 1.1500/1.15486.

- On the lower side major support is around 1.1345 and break below targets 1.1280/1.1200/1.1155.

- Short term trend reversal only below 1.1050.

It is good to sell on rallies around 1.1385 with SL around 1.14375 for the TP of 1.1280/1.1200

R1-1.1437

R2-1.1500

R3-1.1545

Support

S1-1.1345

S2-1.1280

S3-1.1200