According to data published by the national statistics bureau on Thursday, Australia's seasonally adjusted overall employment rose by 60,900 in March, following a revised gain of 2,800 in February. The rise was far above forecasts for an increase of 20,000. After hitting a soft patch in February, Australia's employment bounced back in March rising for the sixth consecutive month suggesting that the labor market was on strong footing.

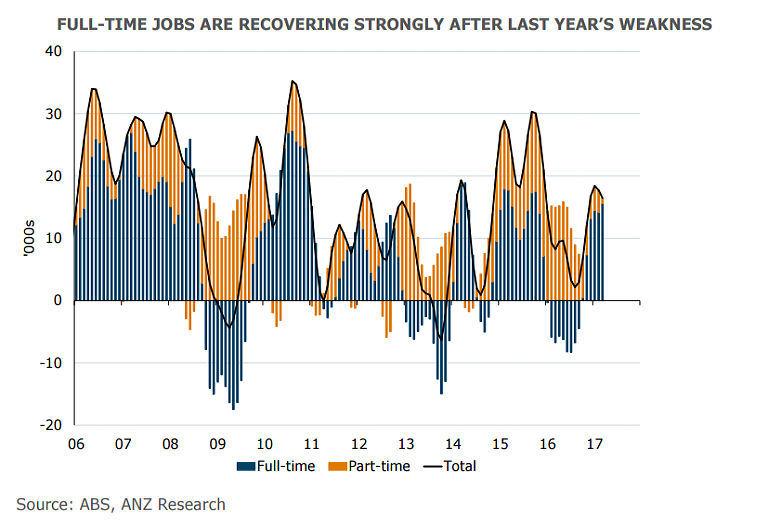

Full-time jobs drove the growth, with 74,500 positions created, the largest rise since June 2011, offsetting a fall of 13,600 in part-time jobs. The unemployment rate remained steady at 5.9 percent, as expected, largely because the participation rate which rose to an eight-month high of 64.8 percent.

"After tracking broadly at around 5¾% for nearly a year, unemployment is now rising in trend terms. Along with still high underemployment, this suggests that there remains significant spare capacity in the labour market which is likely to continue to weigh on wage growth," said ANZ in a report.

A surprising surge in employment in March on the back a revival in full-time work should provide some comfort to the Reserve Bank of Australia (RBA). Economists said the numbers should please the RBA, which has recently described the labour market as soft.

A stubbornly low inflation would have the bank preferring to keep monetary policy as accommodative as possible. But an overheated property market would seem to require higher rates to tame the risks associated with high and rising levels of indebtedness. The latest jobs data would cheer up the Reserve Bank and may keep the doves on the RBA's monetary policy board sidelined.

“The RBA is concerned about the weak underbelly of the labour market, but today’s trend pick-up in full-time hours worked and employment provides some offset. Continued improvement in full-time employment trends is supportive for our Nov RBA rate hike call,” said TDS in a report.

AUD/USD spiked above 200-DMA after stellar jobs data. The pair has currently paused upside at major trendline resistance at 0.7585, bias remains higher. We see scope for test of 50-DMA at 0.7624. Violation there could see further upside upto 0.7680 (March 30 high).

FxWirePro's Hourly AUD Spot Index was at 57.3886 (Neutral), while Hourly USD Spot Index was at -50.5285 (Neutral) at 1200 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom