Bank of Japan (BOJ) ambitious easing has so far failed to achieve targeted inflation path as consumers have scaled back their purchase after sales tax hike of 2% and now latest earnings data released today, show that ambition may remain out of reach as wages are hardly growing.

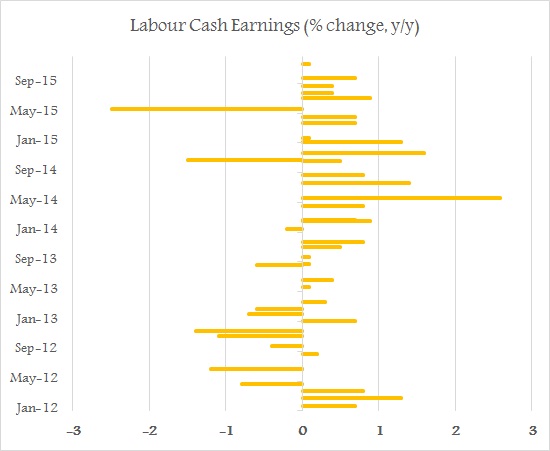

Labour cash earnings reported wages only edged up by 0.1% in December, compared to level a year ago. So economists are posing a serious question - if economy is growing just about 1.6% y/y and inflation is hovering at near zero level, why should companies pay higher wages, more so for firms, focused into domestic market, who are not major beneficiaries of weaker Yen. Bank of Japan's (BOJ) selective buying into equities, are not large enough to compensate corporations to increase wages.

Figure shows, increase in Labour earnings were quite visible and had strong momentum back in 2013/14 but has become more subdued as global growth weakens.

As early as last month, BOJ had introduced negative rates on excess reserve but the current three tier system adopted by BOJ leaves enough wiggle room for banks and total deposit unlikely to earn a net negative until the very late.

Moreover, with negative rate introduction, it is more likely that BOJ would adjust in that front, rather than to boost purchase.

Yen is currently trading at 117.2 per Dollar, much stronger than 125 level seen last year.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons