The prices of bitcoin has been rising higher and attempting to test the stiff resistance levels of $7,300 - $7,650 (refer 2nd chart). The block-halving is on the cards and Bitcoin has been oscillating between this range. If the underlying price is halting at $7k levels after the halving event, bitcoin pessimists and sceptics will again keep vouching it has no price prospects and it can’t recover. If the mining appears to be sluggish and these are the environments that basically make Bitcoin so resilient.

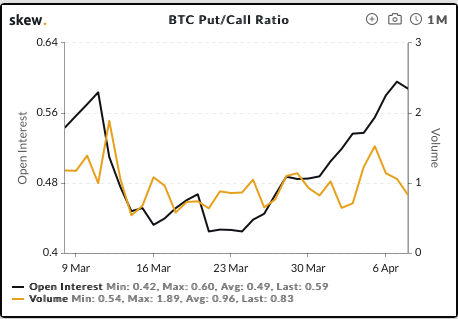

The put/call ratio has been a conducive tool and effective measures of underlying market sentiment for the forecasting future market trend. The put-call ratio emphasizes the difference in trading volume between puts and calls.

Well, it is a ratio of the trading volume of put options to call options. If the number of traded call options outpaces the number of traded put options, then the underlying market is most likely to bounce and vice versa in contrast case.

Such options market sentiment signals a bullish sentiment. The ratio is calculated by dividing the number of traded put options by the number of traded call options.

A put-call ratio of 0.83 was observed today, it was risen to 1.53 level over the weekend (refer 1st chart), that indicates obligations of selling underlying security (i.e. bitcoin) significantly outpaced those with buying obligations. This has seen a halt in the underlying price at the stiff resistance of BTCUSD as stated above.

Usually, Put/Call ratio of below 0.7/0.8 has been perceived as a bullish indicator. The Put/Call ratio for Bitcoin Options is smack in the middle of that range suggesting that traders are poised for a price reversal.

Under such circumstances as stated above, the bitcoin price has stabilized and attempting to create upside traction. On a broader perspective, from April'16, the BTC has spiked from $414 to the all-time highs of $19k, currently, trading at $ 7.4k mark, which is still 1,660% rallies. When this is the case with BTC, could we fairly criticise the performance of the pioneer cryptocurrency?

Needless to speculate anything on trend, and hence, the long hedges were advocated in past as well using CME BTC Futures. It is not prudent to count the chickens before they hatch, if we keep speculating on the next upside target and accumulate fresh bitcoins. Instead, one can certainly uphold the long hedges for now using CME BTC contracts of May deliveries (spot reference: $7,325 levels).

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different