CME and Bakkt are the two predominant and globally renowned bitcoin futures market.

Of late, there has been a divergence in open interest between them, CME ominously missing appeal to the institutional investors as the number of long contracts experienced more than 300% plunge in open interest which is the least WoW drop four months. While Bakkt gains traction during the course of same period. Bakkt futures contracts have surged in the recent times, recording all-time highs during the week surpassing the $15 million USD mark. They took twitter handle to announce record daily volumes of 1,756 contracts.

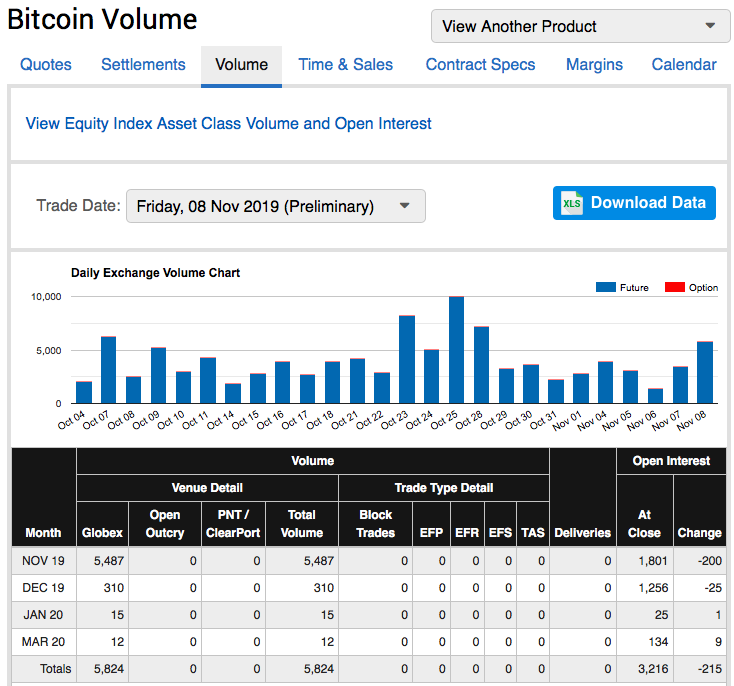

Whereas the number of open interest long contracts on CME is now at October lows despite the 200%+ increase last month.

We recommend for trading purpose, avoid contracts with lower volumes and lower open interest. Generally, the volume and open interests would be small at the early stages of futures contract life and expands as it reaches the maturity period and again drop during close to expiration stage.

If both participants (buyer and seller) in a trade are initiating a new position, the open interest will increase. However, if one is initiating a new position and other liquidating his old position, there is no change in the open interest.

The price of CME BTC futures contracts of front end month has tumbled $9k by -0.23% in last week.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch