China started trading of credit-default swaps (CDS) on the nation’s interbank market after being faced with rising bond failures. In September 2016 the People’s Bank of China (PBoC) approved CDS trading by financial institutions on the interbank market and ten Chinese financial institutions, mostly banks, conducted the first batch of credit default swap (CDS) transactions on November 1st.

China’s rapidly rising corporate debt on the back of uncontrolled credit-fuelled stimulus poses a major risk to the country’s longer-term outlook. China’s corporate debt which currently stands at 169 percent of GDP triggers concerns regarding corporations’ future debt servicing ability and banking sector soundness. China's Dongbei Special Steel went bankrupt last month after failing to repay its debts of several billion yuan nine times.

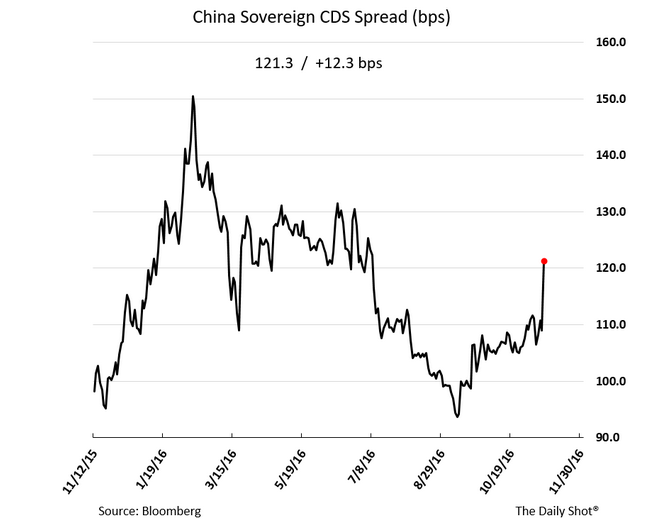

Sentiment toward China will remain volatile over the coming months, impacted by corporate debt overhang, developments in the housing market, concerns regarding economic growth and industrial over-capacity, structural reform progress, and authorities’ intervention. The demand for CDS is increasing as risks of defaults grow.

In March 2016, Standard and Poor’s and Moody’s rated China at “AA-” and “Aa3”, respectively with a “negative” outlook on the back of rather slow progress on the economy’s rebalancing. Fitch rates China in the “A+” category with a “stable” outlook.

In Monday's trading, ten institutions including China’s four biggest banks conducted 15 CDS deals with a combined 300 million yuan ($44 million) of notional principal, according to the National Association of Financial Market Institutional Investors (NAFMII) statement. China’s 5-year credit default swap has jumped 15 basis points (bps) to 125 bps since the beginning of November.

USD/CNY was 0.5 percent higher on the day. At around 1130 GMT FxWirePro's Hourly US Dollar Spot Index was at 49.1506 (Bias Neutral). For more details on FxWirePro's Currency Strength Index visit http://www.fxwirepro.com/currencyindex .

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility