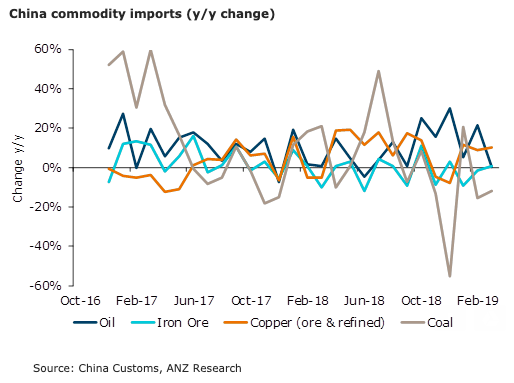

China’s commodities imports recorded solid gains in March on an upswing in seasonal demand. This validates the recent improvement in industrial activities and bodes well for imports in coming months amid rising fixed asset investment and policy measures to support retail spending.

Crude oil imports were steady despite maintenance related closures in key refineries. Oil imports in Q1 increased strongly as lower oil prices encouraged refineries to replenish their depleted stocks. Natural gas imports remained at elevated levels, with low prices likely to have supported demand.

Demand for copper remained strong. Imports of copper concentrate rose 24.9 percent y/y to 1.8mt. When combined with primary copper and products, total imports of copper was up 12.4 percent y/y. This should dispel any myths that copper demand has been soft in China post the Chinese New Year holidays, ANZ Research reported

Iron ore imports rebounded month on month, as steel mills restocked in light of disruptions to Brazilian output. Coal imports rebounded from February but remained weak on a seasonal basis as import restrictions continued to impact trade.

Meanwhile, soybeans imports were weaker than expected. Imports are seen increasing in the coming months as demand picks up from the hog industry, the report added.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality