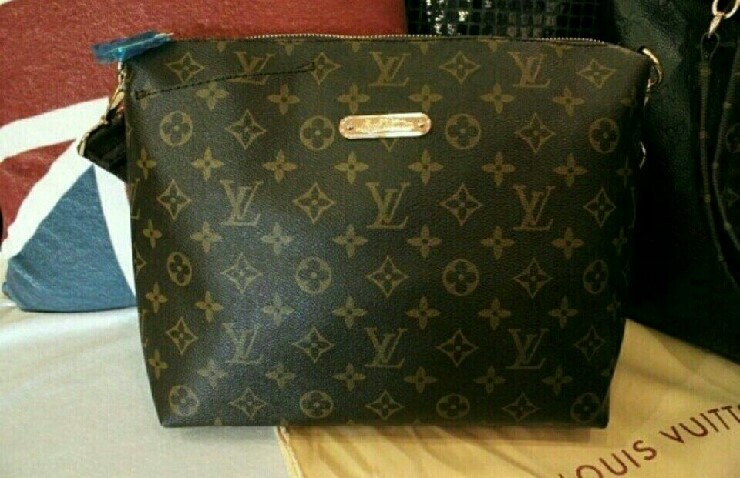

Luxury designer brands such as Louis Vuitton, Chanel, and Hermes have raised criticism in South Korea for the frequency and levels of their price increases.

Since January 2020, Louis Vuitton had raised its prices seven times with the increase rate of its bag reaching almost 50 percent over the past year.

An industry official pointed out that the 50 percent price hike is out of the norm from the usual 5 to 6 percent increase rate.

Meanwhile, Chanel increased their prices on four occasions during the said period.

On Tuesday, Louis Vuitton, Prada, and Bottega Veneta all hiked the prices of their popular products, while Chanel is reportedly reviewing another price increase.

Italian luxury brand Bottega Veneta increased the price of its Mini Jodie bag from 2.29 million won to 2.47 million won, up by nearly 8 percent.

Prada also raised the price of its signature bags by around 100,000 won as Burberry raised the price of its Small Leather TB bag from 2.99 million won to 3.25 million won this month.

Prada, Burberry, and Bottega Veneta were slated to further raise their prices.

The luxury designer brands attributed the price increase to various factors, including exchange rate and wages.

The latest price hike is said to be a domino effect of the high-price strategy implemented by Hermes, Louis Vuitton, and Chanel, which all have strong price negotiation power.

Luxury brands raise prices based on the paradox that products sell better when more expensive since the desire to own intensifies when the item is harder to obtain.

The demand for luxury brand items also escalated due to the COVID-19 crisis, with consumers using money that would’ve been used to travel abroad.

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target