Bearish NZDUSD scenarios below 0.60 if:

1) The NZ housing market slowdown becomes disorderly;

2) The NZ immigration rolls over more quickly;

3) Weaker business confidence sees firms dramatically cut hiring.

Bullish NZDUSD above 0.70 if:

1) NZ fiscal easing is accelerated;

2) Kiwis inflation outlooks begin to ratchet up quickly due to the government’s minimum wage increases.

Whereas Kiwis dollar’s (NZD) weakness has been prolonged in sympathy with high-beta FX. This led us to slightly lower our NZD forecasts last month to reflect the risk of ongoing negative news-flow relating to EM.

Supportive factors over the next month include the Fed’s recent dovish shift, strong equity markets in January, higher dairy prices, and a sovereign rating outlook upgrade from S&P. Beyond 0.6970, the next technical target is 0.7060 – the June 2018 high and also a classical 62% retracement of the major 2018 decline. Beyond the next few months, though, if the Fed hikes further through 2019 then the USD appreciation is most likely, consequently, NZDUSD will drop.

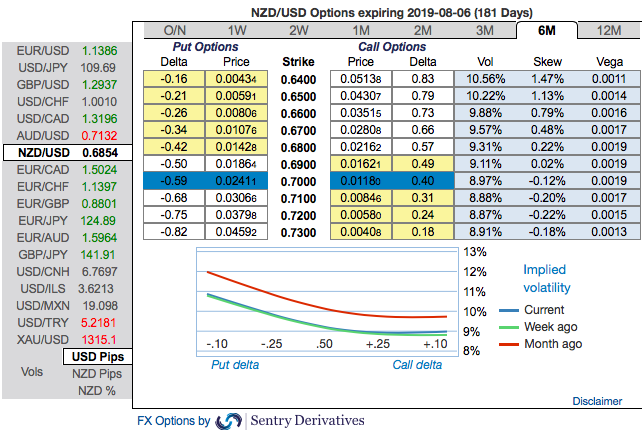

6m IV skews have clearly been indicating bearish risks. Hence, major downtrend continuation shouldn’t be panicked the broad-based bearish outlook amid minor rallies.

These positively skewed IVs of 6m tenors signify the hedgers’ interests to bid OTM put strikes up to 0.64 levels (refer above nutshells evidencing IV skews).

We reckon that the global risks play less favorably for NZ than they do for Australia, and the central bank has reason to be credibly dovish even as the data have outperformed some of the downside risk scenarios laid out earlier in 2018. NZD is also expected to depreciate to 0.65 by end of H1’2019.

While the NZDUSD trade is underwater following positive news reports on a US-China agreement. The erratic nature of news flow is one reason why we had suggested NZDUSD shorts via options in the past. 6m NZDUSD (1%) in the money put options have been advocated, in the money put option with a very strong delta will move in tandem with the underlying.

The trade projection is now out of the money but we maintain exposure given tail risks to high beta FX as noted earlier. Courtesy: Sentrix & JPM

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards -72 levels (which is bearish), while hourly USD spot index was at 133 (bullish) while articulating (at 08:13 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed