Bearish EURCAD Scenarios:

1) Euro area growth fails to rebound much above 1% and the ECB softens the guidance for rate hike towards the end of 2019 or indeed even 2020,

2) The extended political protests in France followed by a populist tide at the European parliamentary elections in May,

3) The US imposes Section 232 tariffs on European car imports.

4) USMCA ratified ahead of schedule;

5) BoC signals a more aggressive path of rate hikes;

Bullish EURCAD Scenarios:

1) Fed ends the hiking cycle but with European growth back at .5-2.0% (so more 2006 than 2000;

2) The continued strong CB demand for EUR.

3) Baseline expectations shift towards NAFTA withdrawal which is negative for CAD;

4) Canadian growth slowdown extends vis-à-vis US;

5) Local/global crude oil prices weaken further

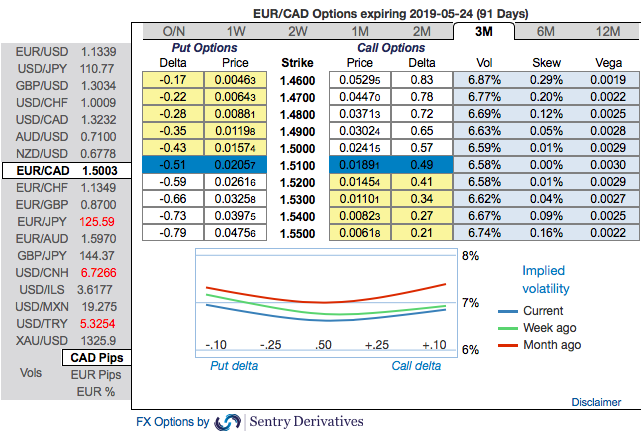

EURCAD OTC outlook: Despite the BoC event, the implied volatilities of this pair have been on the lower side, ranging between 6.89% - 6.94% in 3m tenors. Please be noted that the IV skews of this tenor have been balanced on either side. The positively skewed IVs are stretched on both OTM calls and OTM put options, the underlying movement with lower IVs is interpreted as a conducive environment for writing overpriced OTM calls. Using the three-leg strategy would be a smart move to reduce hedging cost.

EURCAD has dipped from 1.5644 to the current 1.5002 level of-late but spiked previously from the lows of 1.4754 to the peaks of 1.5640 levels. Further material upside risks from the current levels will likely only come on a gradual basis given the BoC’s dovish rhetoric sees in upcoming monetary policy.

The Execution of Options Strategy: At spot reference: 1.5002, contemplating above driving forces and OTC indications, we reshuffle our previous strategy by advocating initiating longs in 3M EURCAD at the money -0.49 delta put, and go long in at the money +0.51 delta call of similar expiry and simultaneously, short 2w (1%) out of the money calls. Thereby, we favor slightly on upside risks as short leg likely to reduce long legs. Courtesy: JPM & Sentrix

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at 32 (which is mildly bullish), while hourly CAD spot index was at -14 (mildly bearish) at 06:06 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts