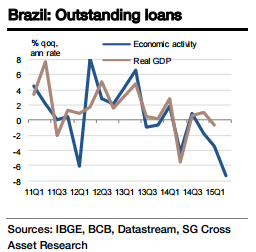

Brazil's economic activity index suggests that the supply-side economy contracted -7.3% qoq (annualised ) or -3.1% yoy in Q2.

"This prompts to project Q2 GDP growth of -1.7% qoq (-7.0% annualised or -2.7% yoy for the non-seasonally adjusted series), which is not significantly different from the earlier forecast. Yet, the economy seems to be heading for a worse contraction than it was expected until just a couple of months back. Both private and public consumption look in worse shape with the anticipated and significant fiscal drag from H2 and inflation set to continue to rise", Societe Generale.

Moreover, data through Q2 show no evidence of investment bottoming despite some gains on the export front (in volume terms) - primarily due to the depreciating currency. The lagged effect of higher interest rates will continue to exert downward pressure on investment, particularly in the current environment where confidence is extremely low.

"Assuming the fiscal situation remains stressed and the unemployment rate continues to rise, the economy will contract -2.1% in 2015 followed by -0.1% in 2016. The only upside, at this stage, could be a potential revival through trade channels. However, we are hesitant to take big bets on this as of yet", states SocGen.

Brazil GDP likely to contract heavily in Q2

Friday, August 28, 2015 6:08 AM UTC

Editor's Picks

- Market Data

Most Popular

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength