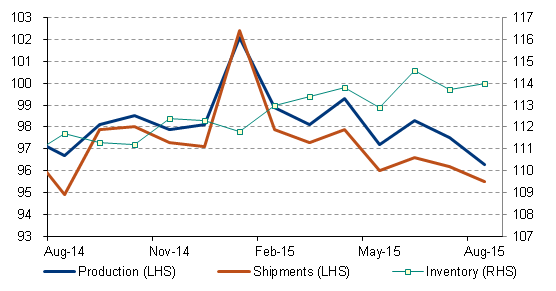

The BoJ's next Monetary Policy Meeting is on 30 October. The meeting will be a one-day affair, at which the central bank is scheduled to update its semiannual Outlook Report and revise its outlook on the economy and prices. Based on recent export volumes and industrial production data.

"We think Jul-Sep real GDP growth is likely to be quite low around 0%, with any gains likely to be very small. In addition, the crude oil prices continue to move up and down in a narrow range that remains below the level assumed in the BoJ's CPI forecast. Consequently, we think the BoJ could cut its FY15 real GDP forecast again from the 1.7% announced in July to below 1.5%, and slightly lower its 0.7% forecast for price inflation", says BofA Merrill Lynch.

Meanwhile, economists see a wide divergence in market views on the likelihood of a BoJ decision in favor of additional easing at Friday's meeting. Indeed, it is difficult to get a good reading on the likelihood of such a decision as August CPI excluding the energy factor indicates a continued improvement with unemployment at its lowest level (3.4%) since August 1997, while uncertainty exists about the length of economic slowdowns in the US, China, and Japan as well as the impact on inflation expectations.

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX